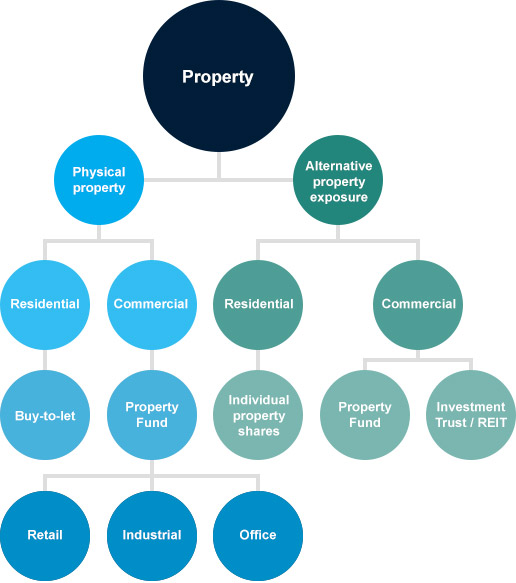

Investing in property is much more than just buy-to-let. While there aren’t many funds that invest in residential property, commercial property offers plenty of investment opportunities. It’s broadly divided into three areas: retail, industrial and office. Most investors access this part of the market through property funds or REITs (Real Estate Investment Trusts).

There are two IA (Investment Association) fund sectors devoted to property. The IA UK Direct Property sector contains funds that invest in bricks & mortar. The IA Property Other sector includes funds that invest elsewhere, such as overseas or in property company shares.

Scroll across to see the full image.

Our view on the Property sector

The performance of property funds usually depends on how the economy’s doing. In good times demand for property increases. This pushes up rents and property prices and encourages more construction. During slowdowns or recessions the opposite happens.

Commercial property is normally preferred by investors in need of an income. That’s because most of the returns come from rental income. As with any investment the value of property investments and the income they could provide can fall as well as rise.

Funds investing in physical property

Property funds that invest directly in bricks and mortar are popular with investors, but we don’t think they’re the best way to invest. This is because commercial property is illiquid so it’s not easily bought and sold. It’s time-consuming, labour-intensive, and expensive.

This creates problems for fund managers. Investors usually want to put a lot of money into their funds when performance is good, and the outlook is rosy. But because it can take months to find and buy suitable properties, the manager often ends up holding a lot of cash and missing out on rising property prices.

Similarly, when the outlook isn’t so good, or when performance has been poor, investors tend to sell property funds. This often forces the manager to sell properties in order to give investors their money back. The best properties are often quickest and easiest to sell, so remaining investors can be left with less attractive investments.

To help with this issue fund managers adjust the pricing of their funds and can stop investors trading them. These decisions are not taken lightly and only in extreme circumstances. It does mean you could receive less than you expect when selling a property fund, or not be able to sell at all for a period of time.

This can hurt the fund’s performance and means returns aren’t solely down to the skill of the fund manager. The high costs associated with buying and selling property also eats into the income received by investors, more so than when buying and selling shares.

Funds investing in property company shares

These funds work in a similar way to funds that invest in company shares. The value of the fund is directly linked to the value of the shares the manager invests in.

They mostly invest in REITs. REITs own and operate a variety of properties and are looked after by an expert management team. This helps to spread risk and means they don’t rely on a small number of properties.

You can also invest in REITs, and other property-related investment trusts, directly. These don’t have the same problems as unit trusts when large numbers of investors try to buy and sell at the same time. But it’s possible for the shares in the REIT or investment trust to trade below (or above) the value of the properties they invest in. This is known as trading at a discount (or premium).

Investment trusts can also borrow money to invest, often called gearing. This can improve returns when markets are rising, but increases losses in falling markets, so it’s higher risk.

We think investors who want to invest in a specialist area should make sure it forms a small portion of a diversified portfolio.