My phone was ringing off the hook with calls from panicked investors on Monday.

They all wanted to know if I was selling off my stock portfolio.

No doubt, things looked ugly.

The market had been spooked by a disappointing jobs report on Friday that revealed the US economy had added just 114,000 jobs in July rather than the 185,000 that economists had forecast.

The unemployment rate edged up to 4.3 percent – its highest level in nearly three years.

Global markets plunged, with Japanese stocks suffering their worst day since 1987.

By Monday morning in America, Wall Street’s ‘fear gauge’ – the Cboe Volatility Index, or VIX – had surged to its highest level since the start of the COVID-19 pandemic. The Dow Jones and S&P 500 registered their largest daily losses since September 2022, closing down 2.6 percent and 3 percent, respectively.

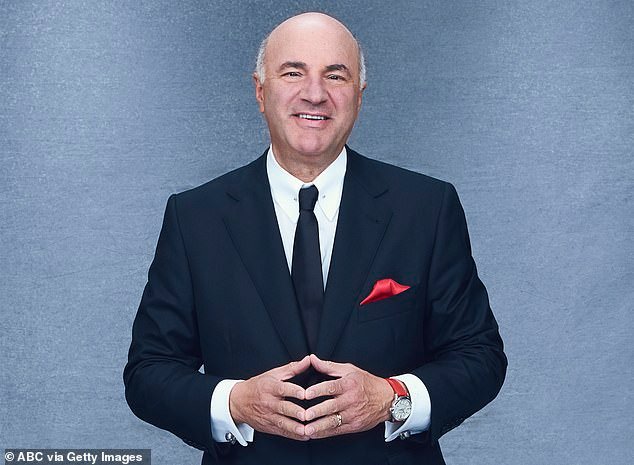

Still my advice was: Don’t Freak Out. Don’t Sell.

And I was right.

On Tuesday morning, global markets are steadying. And even Japan has clawed back a large chunk of Monday’s losses, rebounding 10 percent, as of this writing.

Americans riding this financial rollercoaster may feel like they’re suffering from a case of whiplash.

But there are some valuable lessons to take from Monday’s faux-panic.

My advice yesterday was: Don’t Freak Out. Don’t Sell. I was right.

RECESSION CONFESSION

The weak US jobs report raised fears that the US economy – the engine of world commerce – was heading for a long-anticipated downturn after the COVID stimulus-fueled highs of the last few years.

So, is the US on the verge of recession?

In a word, maybe.

When the Federal Reserve began rising interest rates in March 2022 to reduce investments and cool an economy running hot on billions in stimulus dollars, there was always a risk that they’d slow down economic activity too much.

Ideally, the Fed – which manages America’s money supply in the pursuit of price stability and maximum employment – would arrest rising inflation without causing stagnation. That goal is called a ‘soft landing,’ and I believe that’s still the most likely output.

At the moment, I forecast a 60 percent chance of a ‘soft landing,’ and a 40 percent chance of a recession.

A single piece of economic evidence – like Friday’s jobs report – is not changing my mind.

What happened on Monday in the stock markets was simply a healthy correction.

Stocks have been hitting record highs this year – and tech stocks in the major indices, including the S&P 500, Nasdaq and the Dow, had become overvalued.

Companies in the Artificial Intelligence sector, like AI-chip maker Nvidia, have powered much of the market gains. But projections of the profitably of these companies were overblown.

Nvidia’s stock, which hit a price high in June, fell more than 6 percent on Monday. The so-called ‘Magnificent Seven’ tech stocks – which include Apple and Meta – lost a $650 billion in value.

That’s a staggering sum – but these moves are the sign of a functioning market. There’s been thousands of market corrections in the past and there will be thousands more in the future.

Additionally, the output of the US economy, measured by Gross Domestic Product, is still growing.

Inflation, while stubborn and causing economic pain for Americans in grocery stores and gas pumps, is coming down.

However, if August’s employment report shows another jobs shortfall, then I would say the chances of a recession climb to 50 percent – and investors and retirees better re-evaluate their holdings.

The Dow Jones and S&P 500 registered their biggest daily losses since September 2022 on Monday, closing down 2.6 percent and 3 percent.

The stock market was spooked on Friday after a report revealed US job growth in July had missed expectations.

O’LEARY’S RULE OF THUMB

Indeed, some investors may have been wiped out by Monday’s fall.

If they sold stocks in panic, they’d be even worse off on Tuesday, because they would have missed the rebound.

If that’s happened, they will have learned an important lesson: The market giveth and it taketh away.

So, don’t bet on any one stock or market sector.

There are 11 sectors in the S&P 500, including tech, energy and real estate.

My rule of thumb, which has guided me for decades, is to not hold more than 20 percent of any one sector and no more than 5 percent in any one stock.

If you couldn’t stomach Monday’s volatility then your portfolio is not diverse enough.

There’s no way to predict the market – but investors can protect themselves.

And the closer one gets to retirement age the less risky one should be.

Fed Chair Jerome Powell faced calls to make an emergency interest rate cut yesterday.

The Federal Reserve has held interest rates between 5.25 and 5.5 percent since July 2023.

DON’T FLOG THE FED

Investors on Monday were hysterically questioning whether the Federal Reserve had made a terrible mistake by holding interest rates at a 23-year high since July 2023.

Some were even suggesting whether Fed Chair Jerome Powell should make an ’emergency’ rate cut – skipping the Federal Reserve’s pre-planned, deliberative decision-making process and slashing borrowing rates.

That has only happened seven times since 1987, and it generally follows traumatic events such as 9/11 and the 2008 financial crisis.

The market recovery this morning proved that those calls were ridiculous.

It is not the Fed’s job to react to a single piece of economic data like the job report on Friday. It is the central bank’s responsibility to determine where the economy is going in the next weeks, months, and years and institute steady and predictable policy.

The next Fed meeting is in September.

We’d all do well to wait for their findings.