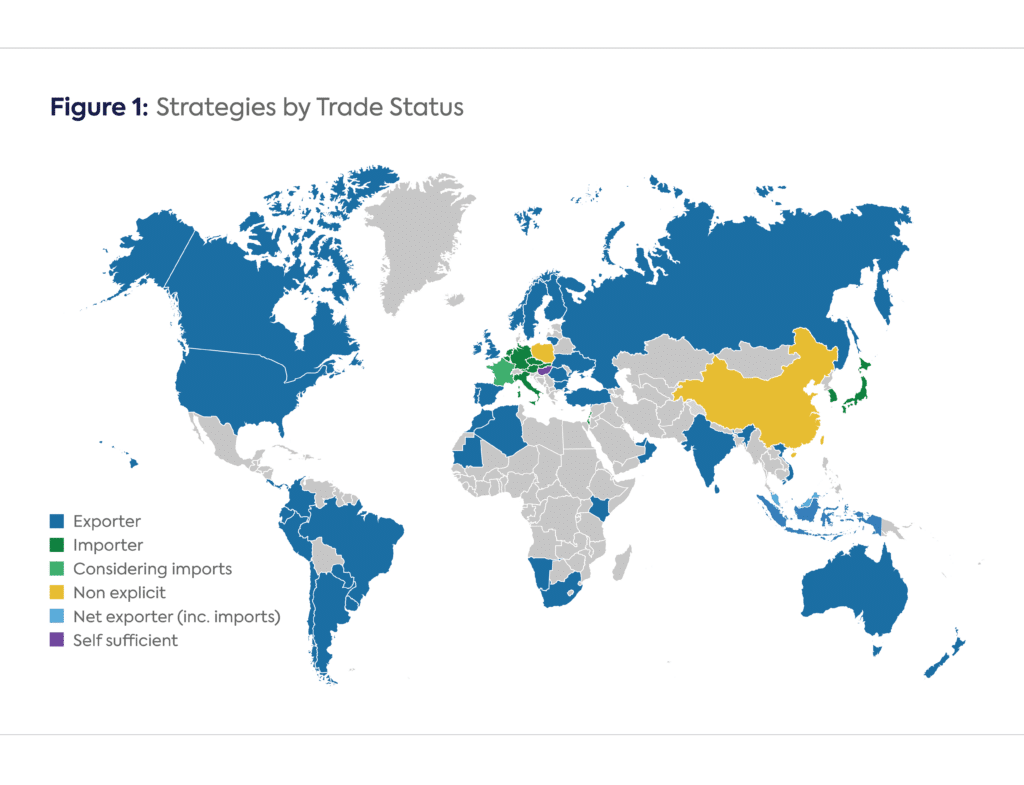

As of April 2024, 58 national hydrogen strategies and roadmaps have been published[1], while many other countries have mentioned targets[2]. A few strategies (Germany, France, Japan) have already been updated[3]. Most strategies position their country in terms of future trade, including whether the nation is seeking importer or exporter status, the trade medium (whether the product imported or exported will be in the form of hydrogen or a hydrogen derivative), and the value, ranking, or economic benefits the nations expect to achieve. This piece is a comparative analysis of the strategies published, focused on these trade-related aspects. It utilizes CGEP’s National Hydrogen Strategies and Roadmap Tracker, which gathers official documents published by governments.

Few Importers, Many Exporters

An examination of the strategies reveals that hydrogen trade would look very different from that of oil and gas/LNG. Only 12 countries are planning to become importers. They are mostly based in Asia (Japan, Korea, Singapore) and Europe (Austria, Belgium, Czech Republic, Germany, Italy, Luxemburg, Slovakia, and the Netherlands). France is also considering importing hydrogen in its last strategy update but has not committed yet. Besides gas-exporting Israel, these countries are already fossil fuel importers, so their energy trade status does not change as they move towards hydrogen. However, Belgium, Italy, and the Netherlands also anticipate becoming trading hubs, servicing neighboring countries.

A few countries, notably China, do not explicitly mention their future trade status. None of the Chinese strategies from both national and provincial governments mention hydrogen imports, which represents a significant uncertainty given the size of the country’s energy and hydrogen demand, and its current importance to fossil fuel markets. Hungary plans to become self-sufficient, even though a significant share of its low-carbon production by 2040 and 2050 will rely on imported gas.

The bulk of the other countries (42) that have released strategies aspire to become hydrogen exporters. They can be broadly split into two categories: existing fossil fuel exporters and new entrants (usually current energy importers). Fossil fuel exporters are eager to preserve their role (and revenues) as energy exporters, transitioning from fossil fuels towards hydrogen and its derivatives. This includes countries as diverse as Oman, the United Arab Emirates (UAE), Algeria, South Africa, Russia, Indonesia, Australia, Canada, the United States, and even Mauritania – a soon-to-be LNG exporter. A few will have a dual approach based on natural gas (and CCUS) and renewable energies, but some such as Algeria, Oman, and South Africa, are moving away from fossil fuels and focusing exclusively on renewable hydrogen for exports[4]. In one of its scenarios, Malaysia seeks to be a net hydrogen exporter while also importing some volumes.

New entrants into the hydrogen market are currently not energy exporters but aspire to capitalize on their vast renewable energy potential in the future. They include some countries in Africa (Kenya, Namibia, Morocco), Latin America (Chile, Ecuador, Paraguay, Uruguay), Asia (India, Indonesia), and Europe (Spain, Portugal, Turkey, and Nordic countries). Despite the European Union’s targets to become an importing region, ten EU countries do have plans to become exporters.

Besides the economic benefits countries can derive from hydrogen (including revenues, job creation, and industrial development), potential exporters also cite the desire to attract foreign direct investment and align the strategy with broader economic diversification efforts. Clean hydrogen derivatives can also replace existing imports of fossil-fuel-based methanol or ammonia. Additionally, exporting countries have a dual approach by developing the domestic market alongside exports. India anticipates that export market growth will have a positive cascading effect on domestic production. In countries such as Kenya, Canada, the United States, the UAE, Turkey, and Ecuador, the domestic market seems to take precedence in terms of timing and/or volumes, although the United States is also seeking to use hydrogen to enhance the energy security of allies. Others, such as South Africa and Argentina, prioritize exports: Argentina plans to export 4 million tons (Mt) of hydrogen out of the 5 Mt produced by 2050. Malaysia anticipates export revenues will be higher than domestic sales.

Will Import Requirements Align with the Ambitions of Exporters?

Reviewing the available country plans does not give a clear picture of how well hydrogen supply and demand will match up in this emerging energy market. Not all potential importers quantify their import needs (Austria and Singapore have not released any projections, for example). Other countries rarely publish import requirements for each milestone (2030, 2040, or 2050). In addition, 27 of the 42 countries seeking to become exporters do not publish projections of export levels.

Seven countries have published expectations for 2030, totaling 8.9 Mt of imports in the most optimistic scenario, while five potential importers (notably Singapore) have not. For 2050, only four countries provide estimated import requirements. The Czech Republic provides a detailed forecast of demand up to 2050, but the lack of information on domestic production beyond 2035 does not provide a clear picture of future imports.

Plans for hydrogen exporters are likewise incomplete. Published export projections total nearly 5 Mt by 2030, with the UAE and Mauritania having the highest export targets for that period (0.6-1.8 Mt[5] and 1.2 Mt, respectively). The projections do not include India, which has said its production of renewable hydrogen could hit 10 Mt by 2030 if export markets show strong growth, and will target production of 5 Mt if it does not. Additionally, critical countries such as Norway, Oman[6] and Australia have not yet made any targets public.

Trade Mediums – Still Much Uncertainty

Due to the complexities of hydrogen transport, many trade mediums are being explored. Hydrogen can be transported in a gaseous state (by pipeline), as well as under various liquid forms – liquid hydrogen, liquid organic hydrogen carrier, ammonia, methanol, e-fuels[7]. Finally, hydrogen can be transported as a (semi)-finished industrial product such as green steel.

Meanwhile, the thinking around hydrogen trade has been evolving. The first hydrogen strategies published in the late 2010s/early 2020s often mentioned all these various options (except for green steel) since they were all considered at that time. Options such as green steel have become more prominent in some of the latest strategies published (Namibia, Mauritania, UAE, and even the United States in a high case scenario). Many mention hydrogen derivatives without specifying which ones (ammonia, methanol, or e-fuels) are considered, while others specifically mention one or two derivatives. The latest strategies tend to be more specific about mediums and quantities associated (Algeria, Mauritania).

Most importing countries consider a relatively wide range of these trade mediums. They are weighing factors such as cost, what delivery mechanisms will be available from suppliers, and geographical constraints. Germany and the Netherlands, for example, seem to be open to various supply options, while landlocked Luxemburg is only considering pipeline imports of hydrogen and e-fuels.

The same applies to potential exporters: most do not restrict themselves to specific trade medium. However, in some strategies (Brazil, Oman), there is no mention of what the trade medium will be, even though ammonia seems to be the preferred option in Oman based on the projects currently being considered.

One of the most popular trade mediums appears to be ammonia, which is widely mentioned by both importers and exporters — it is discussed by 36 countries of the 51 countries that expect to trade and that give specifics on trade mediums. This category also includes the export of fertilizer products, which is under consideration by Kenya, for example. The ammonia option benefits from the fact that the trade already exists and the product is already used by fertilizer producers. It also has potential to be used in the maritime sector. Japan also envisages mixing it with coal in the power sector. Meanwhile, the use of pipeline hydrogen is favored by many European countries, as well as their neighbors (Norway, Algeria, Morocco, or even Russia). Outside of Europe and its neighbors, only Canada envisages using pipeline exports, in this case to the United States.

Finally, e-fuels (including e-methane), methanol, and liquid hydrogen appear moderately popular with 19, 22 and 20 countries mentioning them specifically (although they might be included in the broader “derivatives” category). The option to transport via liquid organic hydrogen carriers is the least mentioned among all the hydrogen transport options.

Notes

[1] Anne-Sophie Corbeau, Rio Pramudita Kaswiyanto, “National Hydrogen Strategies and Roadmap Tracker,” Center on Global Energy Policy, March 29, 2024, https://www.energypolicy.columbia.edu/publications/national-hydrogen-strategies-and-roadmap-tracker/. This does not include regional strategies.

[2] Emiliano Bellini, “Saudi Arabia in Prime Position for Green Hydrogen in Global Energy Landscape,” PV-Magazine, January 18, 2024, https://www.pv-magazine.com/2024/01/18/saudi-arabia-in-prime-position-for-green-hydrogen-in-global-energy-landscape/.

[3] Ibid.

[4] Algeria would produce low-carbon hydrogen based on natural gas for its domestic market.

[5] The reference year for the UAE is 2031.

[6] Oman’s targets include domestic demand and exports.

[7] Ammonia, methanol, e-fuels are often referred to as “derivatives”. In this instance, e-fuels also include e-methane.