In Germany, three-digit growth rates illustrate the recent interest in large-scale battery systems. The Federal Network Agency (Bundesnetzagentur) has registered 169 sites larger than 1 MW, the oldest dating back to 2014. They have 1.26 GW of output and 1.43 GWh of capacity.

Norwegian company Eco Stor AS and its German subsidiary Eco Stor GmbH plan to add 1.4 GWh in just three projects. Eco Stor is planning 300 MW/600 MWh batteries in the southwestern state of Rhineland-Palatinate and in Saxony-Anhalt, in the northeast. A 100 MW/200 MWh battery will be installed in the northern state of Schleswig-Holstein. The company wants 20% of a burgeoning market, with the Bundesnetzagentur tracking 123 projects with output of 1.55 GW and 2.4 GWh of capacity at the planning stage.

Some are behind schedule but with more announcements expected in 2024, Germany is anticipating a 190% rise in energy storage capacity from planned and under-construction batteries.

Storage capacity ratios are rising, too, from a typical 1:1.1 output-to-capacity figure to 1:1.6. Current “one-hour,” 1:1 batteries generate most of their revenue from avoided grid charges and even out minimal grid fluctuations within seconds, in a service known as “primary control energy.” The latter, however, is only linked to tenders for around 555 MW of battery output capacity and avoided grid charge income has not been paid to sites commissioned since Jan. 1, 2023.

Two-hour trend

Big batteries can participate in day-ahead energy markets and the five-minute lead-time continuous intraday market. Electricity transmission system operators (TSOs) also pay for secondary balancing energy services, available within five minutes, instead of primary control energy.

Nevertheless, “if I only do intraday in the future, I’d rather build a two-hour storage system,” said Hans Urban, renewables consultant at Eco Stor.

Wider applications for longer-duration storage and rising renewable energy generation bring a need for regulatory measures, and batteries operating across simultaneous short-term markets must be well managed. “That’s the point where the electricity market people come with their trading,” added Urban.

They decide, for example, whether a gas-fired plant should cover short-term demand and at what hours a pumped storage plant absorbs and releases energy. With the advent of big batteries, such decisions are more complex and made faster.

Electricity is typically traded in units of 100 kW. Each of the 10 units provided by a megawatt-capacity battery can supply primary control energy in the morning, secondary control energy at midday, and then be used in the day-ahead market. German tenders for energy balancing typically have four-hour slots, but 15-minute slots are available, depending on sub-markets and trading platforms.

Software, not people

Munich-based startup Entrix typically quotes 200 trades per megawatt per day. That’s 20,000 trades daily for a 100 MW battery. Unsurprisingly, that requires software because transactions, as Urban said, “are so fast that they can no longer be done manually.”

It may be that “a lot of trading on the electricity market is still carried out manually,” according to Bastian Hechenrieder, Entrix’s head of product development, but the aim is to fully automate battery storage market functions with an algorithm monitoring relevant markets around the clock and making trading decisions. As a result, companies now offer battery storage trading as a service.

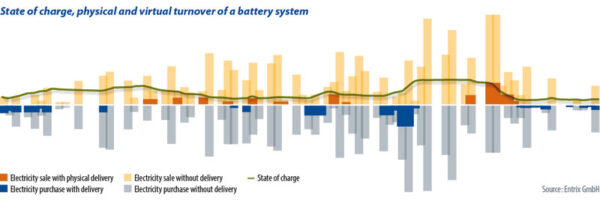

Those concerned about battery degradation might be alarmed by the enormous number of transactions involved but the trading day of a large battery is relatively leisurely, typically with two full cycles per day. The majority of trades do not affect the battery at all. Like certain transactions on stock exchanges, profit is made simply by the fact that a particular product has a lower price at the time it is bought than at another time when it is sold again.

The fundamental difference to high-frequency trading on the stock exchange is that everybody involved benefits from algorithm-driven trading on the electricity market. As Urban pointed out, arbitrage operators “simultaneously dampen the price fluctuations from which they actually earn.” The electricity market functions on the principle of supply and demand. If electricity is plentiful, and therefore cheap, traders are happy to buy, which stabilizes the price again. If electricity is scarce, and therefore expensive, everyone wants to earn money and a greater number of offers will cause prices to fall.

Virtually virtual

The art of a well-written algorithm is to conclude as many trades as possible in which the battery storage does not need to be actively used at all. At Entrix, that is referred to as “virtual trading.”

For virtual trading, it is essential that a trader is also able to execute the transaction that is currently pending. If they have agreed to deliver a megawatt hour and are unable to procure it in good time at a price that is advantageous, they must still honor the agreement. This huge number of rapidly changing options makes up a large part of the work of traders. Lennard Wilkening, CEO at Hamburg-based startup Suena, said that he is often asked whether the proportion of virtual trades can be quantified with a set price. That’s not easy, he said, because the range is “three to 10 times what physically passes through the battery.” With the returns that are generated with a large storage facility, the proportion of those types of trades is much lower, due to the low margins.

At Entrix, the non-physically realized part of trading volume can comprise “more than 90%.” Despite lower margins, this is an important statement for customer acquisition, because the battery only serves as a backup. It earns its money in its “sleep,” so to speak, and therefore the trades have no impact on the battery itself in terms of wear-and-tear battery degradation. It is also essential that a battery is cycled as gently as possible. Entrix’s Hechenrieder explained that there are “various degrees of freedom” that depend on a manufacturer’s specific warranty conditions, local conditions, and a battery operator’s specifications.

Commercial storage

The potential for storage systems below the 1 MW threshold to use automated trading is now being put to the test by Levl Energy, a spinoff from Enpulse Ventures, which is a subsidiary of German energy company EnBW that was set up to promote energy startups.

The Levl concept centres on commercial storage systems with a capacity of a few dozen to a few hundred kilowatt-hours. These should be able to continue to fulfil their original purpose of peak load capping or optimizing self-consumption without restriction. The software developed by Levl allows commercial storage units to be integrated into the network without additional hardware.

As operating time increases, calculations become more precise. In this way, and aggregated into one balancing group, commercial batteries can then be transferred to a marketer and used for arbitrage transactions. Levl could, therefore, bridge the gap between companies such as Suena, Entrix, and other battery marketers and commercial storage operators. The search is currently on for cooperative grid operators.

The number of parties involved in the multi-layered and rapid marketing of electricity from battery storage systems could increase significantly through players like Levl. The requirements for the software used in this market won’t be getting any simpler but the industry is bullish. Suena CEO Wilkening said there should still be “an option for manual intervention,” not only for technical reasons, but also in the event that a lucrative trading opportunity arises that the algorithm does not recognize – paradoxically, with the goal of preventing this from happening in the first place.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.