Conversely, the proportion of UK shares held by British individuals has fallen from 12pc in 2021 to 10.8pc in 2022, according to the Office for National Statistics.

The Government has been looking at ways to reinforce Britain’s capital markets and boost investment, with Chancellor Jeremy Hunt unveiling a series of reforms in his Mansion House speech last year.

eToro is planning to bolster its offering of London-listed stocks in the coming months, challenging the likes of Hargreaves Lansdown and AJ Bell. Currently, it offers around 300 UK stocks compared to several thousand across the Nasdaq and New York Stock Exchange.

Mr Assia said: “We are planning to add about 1,000 UK stocks in the coming weeks and expanding our relationship with the LSE for better execution.” He recently met with Julia Hoggett, the chief executive of the London Stock Exchange, to discuss the expansion.

eToro is also looking to boost its Isa offering and is receptive to the idea of a British Isa, proposed by Chancellor Jeremy Hunt, which would provide a £5,000 tax-free allowance to invest in UK stocks.

There are calls for the Chancellor to go further: investment advisers and brokers have suggested scrapping or reforming stamp duty on share transactions, currently a 0.5pc levy.

Mr Assia said: “It creates a disincentive to trade.”

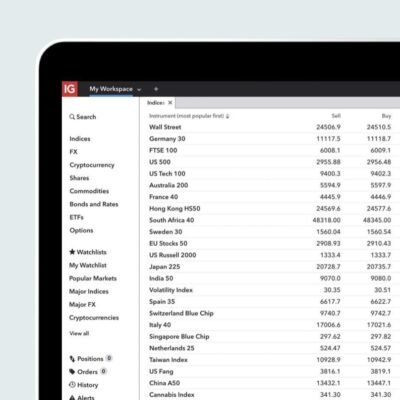

Some of eToro’s other offerings are more speculative than simple shares. The Israeli business was quick to offer cryptocurrencies such as Bitcoin, and now provides a variety of the digital assets – many of which have little apparent utility.

In 2022, it bought an expensive Super Bowl advert at the so-called “crypto bowl” where companies including Coinbase, Crypto.com and the now bankrupt FTX splashed out on prime-time adverts.

The cryptocurrency industry has long attracted scrutiny amid fears it can be used for money laundering and that it is replete with scams. In a report published last week, it emerged the Financial Conduct Authority (FCA) opened 95 money-laundering cases last year against cryptocurrency businesses, out of a total of 375 investigations.

Unlike many cryptocurrency businesses, eToro is regulated in the UK under the FCA’s crypto asset regime. Mr Assia says the FCA represents the “gold standard” for cryptocurrency trading.

Founded in Tel Aviv in 2007 by Mr Assia and his brother, Ronen, eToro made profits of more than $100m last year on revenues of $630m.

Despite its Israeli origins, Mr Assia said he considered Britain and Europe to be eToro’s “home market”.

Israel’s tech sector, like the rest of the economy, has been rocked by the country’s war with Hamas. Workers have been called up to the military, while those staying behind have been forced to retreat to bomb shelters in between meetings.

Mr Assia, who lives in Israel, downplayed the impact on eToro.

He said: “We haven’t seen any impact to the day-to-day operations of the company. Roughly half our personnel are in Israel.

“We have always been prepared from coronavirus to work from home… We are actually required by all the various regulators to have disaster recovery sites and global systems, all of that has been in place.”

He added: “We still have a team of developers in Ukraine.”