The are two main options, and the right choice could mean tens of thousands of dollars more in your pocket each year.

But when it comes to investing, there are so many mixed messages and conflicting points of view.

Some people swear that one thing is best, and others say the opposite.

It’s no wonder so many people end up stuck on the fence, not sure what to do and so instead do nothing.

But when this happens, you create an “opportunity cost” that you can never get back.

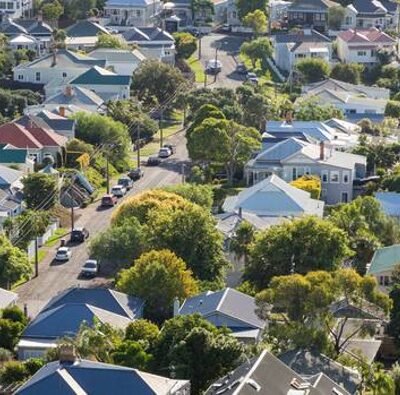

The two main options for investors are shares vs. property.

Making the right choice here means tens of thousands of dollars more in your pocket in the years ahead.

But figuring out which option is best for you isn’t easy.

The two main options for investors are shares vs. property. Picture: iStock

Benefits of share investing

Buying shares is a powerful way to get ahead, because it leverages the power of compound interest to grow your money.

Consider this example.

You start with $0 today and invest just $10 every day.

After 10 years you’ve saved and invested a total of $36,500, but because of the power of the sharemarket and compound interest your money would have grown to $61,598 (based on the long term sharemarket return of 9.8 per cent).

This sounds pretty good, but keep going and it gets even better.

Over the next 10, 20, and 30 years your money would grow to be worth $225k, $659k, and 1.81 million respectively.

This is an incredible result for investing just the cost of a couple of cups of coffee a day – and shows how effective share investing can be in growing your assets and wealth.

Compound interest is the most powerful force in the universe, Albert Einstein once said. Picture: iStock

Benefits of property investing

By far the biggest benefit you get from investing through property is the fact you combine your savings with money borrowed from the bank, then invest a larger amount than you could with just your savings alone.

Using the banks’ money to get ahead can fast track your asset building and wealth creation. You can get there without debt, but your progress will always be slower going and harder fought.

When you borrow money to invest, you end up with more investments than you could build with just your savings alone.

This means more investments growing for you, and therefore more investment profits.

You can combine your savings with money borrowed from the bank. Picture: iStock

How do shares vs. property compare?

Ultimately if you’re making money decisions, it’s a numbers game – and you want to choose the option that will help you make the most progress getting ahead.

To directly compare investing in shares vs. property, consider this example.

You’ve put in the work to save up $100,000 and are considering where best to invest it.

If you were to invest through shares, based on the long term sharemarket return of 9.8%, your expected return would be $9,800 over the next 12 months.

Instead if you took your $100,000 and used it as a deposit on a $750,000 property, your investment return would be $47,250 based on the long term property growth rate of 6.3 per cent.

Then on top you’d receive rental income on your property investment, which would make the total return on your investment even higher.

In this case, your return from investing into property is $37,450 higher every single year even though you’d invested the same amount of money.

It also shows that even though the return on shares is higher than property, the total return would be higher because your investment is 7.5 times as large ($750k vs. $100k).

What else should you consider?

Numbers are one side of the equation for investors, and the other is risk.

Most people are risk conscious when it comes to money and investing. It’s natural and smart to worry about taking a costly misstep that will set you back.

Ultimately, property investing does come with higher levels of risk than investing through shares.

When you invest with shares, if you plan to invest a set amount of money each week or month, then something changes in your situation and you can’t or don’t want to, you can simply cancel your investment.

When it comes to property, once you’ve purchased your property you need to make your mortgage payments every month without fail, and on top cover all of your ongoing property expenses like rates and insurance.

This means there’s a risk around your cashflow or changes in your situation.

On top of this, you’ve got the risk of rising interest rates, something many Australians are acutely aware of off the back of the fastest interest rate tightening cycle in a generation.

If you’re considering buying property, it’s important you take the time to plan well.

You should look at whether the property fits not just tomorrow, but for every tomorrow ahead.

This is particularly important if you’re expecting changes to your finances, like starting a family, starting a business, or changing jobs or careers.

It’s also important when you buy property that you have a solid emergency fund to fall back on and protect you against the unexpected.

The wrap

You can see from the figures above that property is the winning strategy when it comes to growing your assets and wealth.

It beats shares hands down over the short term, and those benefits compound to make it significantly better over the long term.

But it does come with risk that’s important to manage.

You need to invest time (and potentially money) in getting your plan right, covering your key risks, and protecting you from the unexpected.

While this risk is there, it can be managed well with the right approach.

And when you get this right, you’ll seriously fast track your financial progress.

Ben Nash is a finance expert commentator, podcaster, financial adviser and

founder of Pivot Wealth, and author of soon-to-be-released book, Virgin Millionaire.

Ben runs regular money education events to help you save more and invest smarter.

You can check out all the details and book your place here.

Disclaimer: The information contained in this article is general in nature and does

not take into account your personal objectives, financial situation or needs.

Therefore, you should consider whether the information is appropriate to your

circumstances before acting on it, and where appropriate, seek professional advice

from a finance professional.