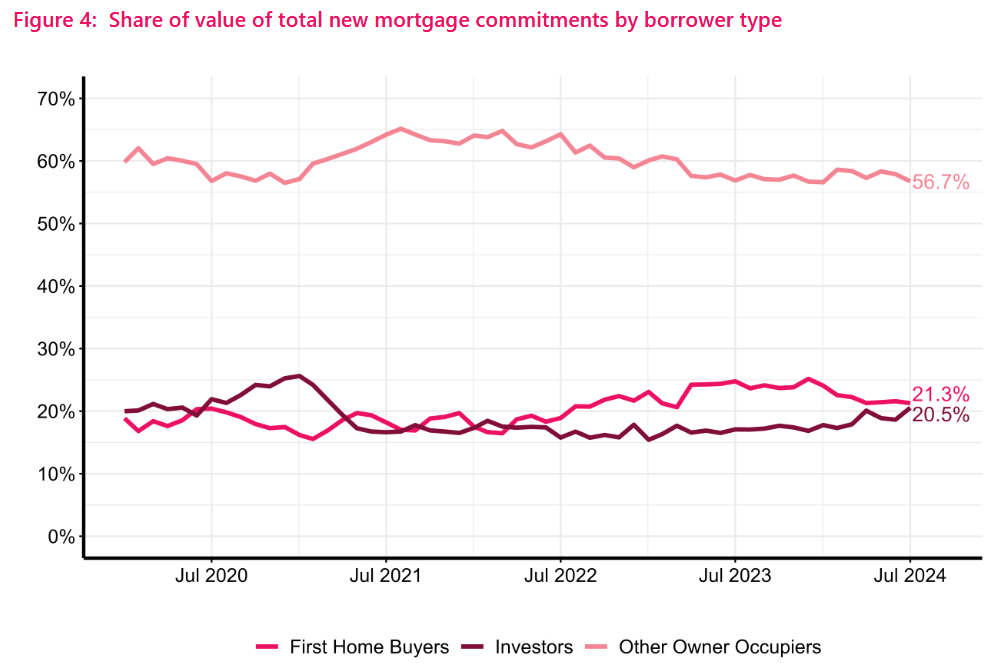

Investors took their biggest share of the mortgage advances last month in three-and-a-half years, according to the latest figures from the Reserve Bank (RBNZ).

In a month that showed a bounce-back from a dire June, investors took a 20.5% share of the $6.652 billion in committed mortgage money.

This is the highest percentage for the investor grouping since the 21.8% recorded in March 2021.

And the $1.366 billion taken by the investors was the highest numerical total since November 2021.

For the investors this is all still a far cry from the days back in 2016 when this grouping was taking around 35% of mortgage money.

However, with more favourable conditions in place for the investors under the Coalition Government with restoration of interest deductiblity and a shortening of the bright-line test timeframe, economists have been looking for signs of more investor interest and what this could do to rekindle the housing market, in which prices have recently begun going backwards again.

With interest rates now going down quickly, the attitude of the long-side-lined investors will be key in setting the housing market direction next year.

While the investors have been on the sidelines, the first home buyers have enjoyed record shares of the mortgage money. In December 2023 the FHBs had a high-water mark of 25.2% of the mortgage money in that month.

However, since then the share has gradually been declining. In July the FHB share was down to 21.3%, while the $1.415 billion borrowed by this grouping was not much ahead of the investors – bearing in mind that FHB’s have had a bigger monthly total than the investors every month since March 2022 – so, for nearly two and-a-half years.

In terms of the overall total of monthly mortgage money, RBNZ said that on a seasonally-adjusted basis it was up some 5.4%.

Compared with the same month a year ago, the figure was up by about a third and it was the highest July figure since 2021.

In terms of numbers of mortgages taken out, the 17,442 in July was a big bounce from the very low 14,590 in June and was in fact the second highest monthly total so far this calendar year.