Buying a house usually means years of monthly payments to a bank. But the terms are surprisingly negotiable — and trading your existing rate for a lower one can save you thousands of dollars

If you bought a home in the US in the past few years, a period when mortgage rates surged to their highest levels in more than two decades, you probably had a plan: “Date the mortgage rate and marry the house.” The time to break up with your current rate for a lower one may be approaching — but you’ll want to read the fine print closely before autographing a new deal.

How can homeowners ditch their current rates? By refinancing their mortgage. A mortgage refinance, or “refi” for short, allows homeowners to negotiate new loan terms, including a lower interest rate. If the market interest rate is lower than your existing one, you may be able to snag a lower rate and shave thousands of dollars off your annual payments.

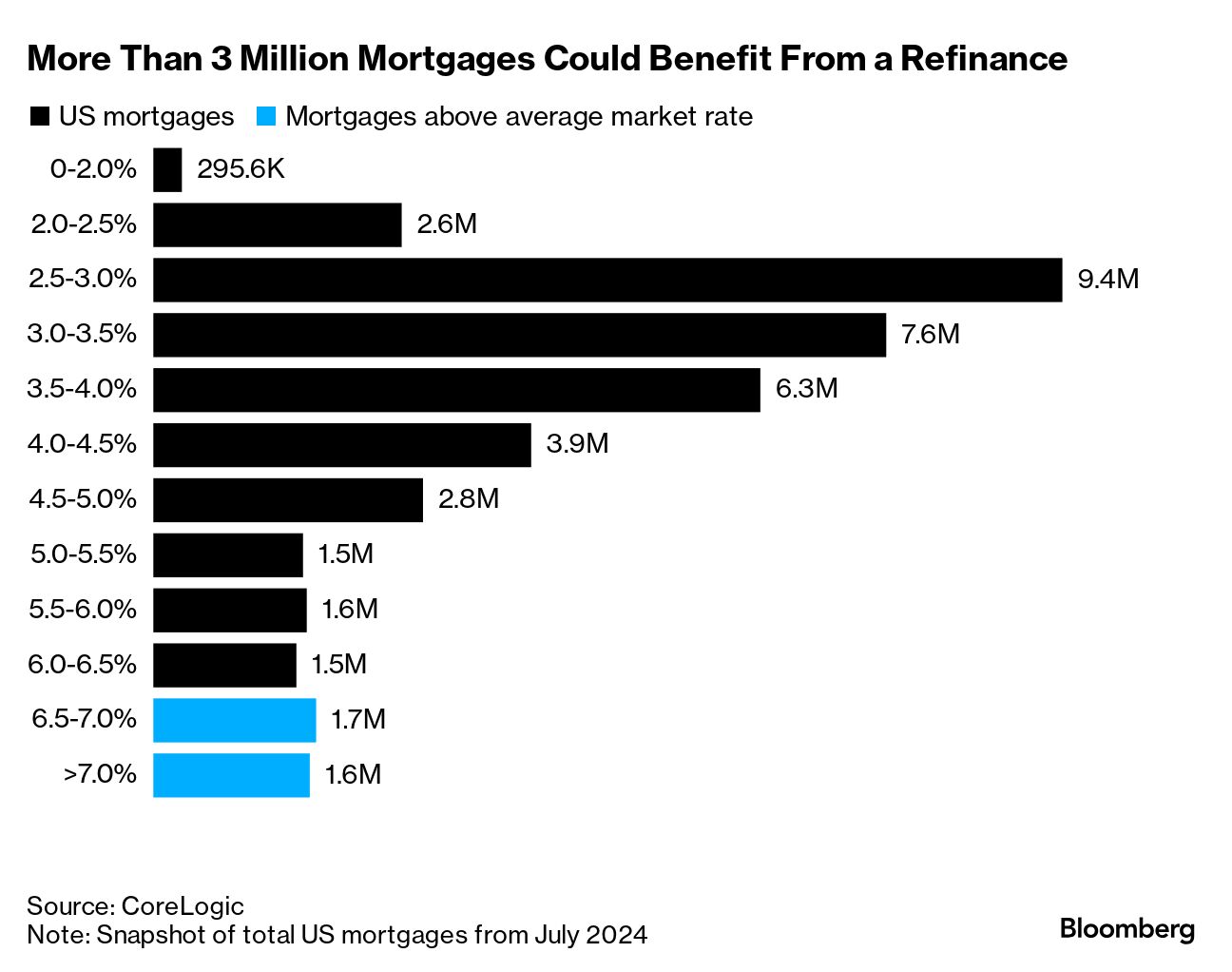

After a pandemic golden era of cheap mortgages, 2022 saw borrowing costs soar. Lenders who once approved 3% interest rates were suddenly offering home loans with rates north of 7% by 2023. The whiplash sidelined many buyers. Others who needed a new place to call their own — for a growing family, a new job or any number of other life events — had to swallow the extra cost. As of July 2024, some 3.3 million mortgages with a rate above 6.5% could benefit from a refinance. Those most likely to refinance are homeowners who took out a loan between 2022 and 2024, according to Molly Boesel, a principal economist at real estate analytics firm CoreLogic.

The time to refinance and secure a lower rate has arrived — for some. Applications to refinance mortgages started to pick up after the Federal Reserve cut rates in September.

While declining rates may seem enticing, financial experts caution borrowers to make sure they know what kind of option works best — or whether they should even refinance their mortgage in the first place. Here’s how the experts say borrowers should navigate a potential refi.

Decide Whether a Mortgage Refi Is Right for You

When a homeowner refinances a mortgage, they’re effectively trading in an existing home loan for a new one, according to Keith Gumbinger, vice president of HSH Associates. A homeowner can utilize the equity they’ve built in their home to apply for another mortgage with different loan terms — a lower rate, smaller monthly payments, a shorter loan term and more. Once a refi is approved, the lender uses the new mortgage to pay off the old one, leaving the borrower with a single loan and new monthly payments.

But nothing is free — and that goes for refinancing, too. Lenders make money by originating the refinance loan, charging closing fees upfront, rolling the closing costs into the balance of your refinanced loan, or locking in an interest rate slightly above the going market rate[1]. Then, the new refinanced loans are often packaged into mortgage-backed securities and sold to investors, said Greg McBride, chief financial analyst at Bankrate.

Refinancing a Mortgage Can Mean Big Savings

Note: Used average Freddie Mac 30-year fixed mortgage rate as of Sept. 26, 2024 Source: NerdWallet refinance calculator

That’s why experts advise borrowers to do their homework on how a mortgage refi fits into their finances. “When you’re talking about changing your life’s largest debt, think about how this all integrates into your larger financial picture,” said Gumbinger. To understand whether it’s worth refinancing, experts advise borrowers to:

Understand Where You Are on Your Existing Mortgage

Determine your home equity[2], which is the difference between the value of the home and the amount owed on the mortgage. The more equity you have in your home, the less risky you are to the lender — which means you’re more likely to get better rates and fewer fees.

Ensure You’re a Good Candidate for a New Loan

Homeowners still need to qualify for a refinance. When you apply for a refi, the lender will review your finances to assess your risk level and determine your eligibility. So check your credit score and try to settle any outstanding debts, which can help you negotiate favorable mortgage terms, said Gumbinger.

Do the Math to Figure Out If You’re Financially Ready

Get an idea of how refinancing will impact your finances by comparing new mortgage rates with your existing ones. But you’ll also want to calculate the closing costs and compare that to the mortgage savings associated with a refinance, said Dustin Smith, a financial adviser at Wealth Enhancement Group.

Also, be aware of the title fees, private mortgage insurance costs and mortgage taxes in your home state, said Melissa Cohn, regional vice president at William Raveis Mortgage. The most cost-effective way to fund a refi is to pay the closing costs[3] upfront, so save up some money ahead of time if possible.

Choose a Refinancing Option

There are many mortgage refinancing options available to homeowners, said Gumbinger. Start by prioritizing your desired outcome. If your goal is to…

Consider a conventional rate-and-term refinance, which changes the loan’s interest rate, the loan’s repayment term or both. Lenders typically allow mortgages to be modified to 10-, 15-, 20-, 25- or 30-year terms. Since most borrowers refinance to reduce their monthly payments, they often reset the clock with a new 30-year mortgage. Shortening a payment period increases monthly payments and reduces the total interest owed on a mortgage.

Ask for a cash-out refinance. This option involves taking out a bigger loan that exceeds the balance on your existing mortgage. At closing, the borrower pockets the difference in cash and can use the money as they see fit. Consider this path if your home value has risen or you’ve built up your equity. While cash-out refis allow borrowers to access a lump sum, they also increase monthly payments.

You can still get approved for a no-closing-cost refinance, which allows you to refi and get a lower rate but not have to pay the closing costs upfront. Instead, the lender will either roll those expenses into the loan or set an above-market interest rate. So instead of refinancing at 6.3%, you may need to settle for 6.5% — which could still make refinancing worthwhile.

Other refinancing options may depend on the type of home loan you have and your financial situation. If you…

Receive a Large Amount of Money

Try a cash-in refinance. This type of refi allows borrowers to make a large payment on a home loan to reduce the principal balance and secure a new rate. It’s a good idea for those who have benefited from a financial windfall, whether it’s from a bonus, tax return, inheritance or other situation. Your money is better used paying down a mortgage at 7% than investing in interest-bearing investments, like certificates of deposit, said WEG’s Smith.

Have an FHA, VA or USDA home loan

A streamline refinance is available. Because these mortgages are insured by the government, the process requires less paperwork and underwriting, making it faster than a conventional refi. Streamline refis operate similar to other options but just help eliminate some of the process.

Want to Keep Your Current Mortgage

You might be able to ask for a mortgage modification, which involves asking your lender to modify the terms of your existing home loan when you’re behind on payments. But this refi-without-a-refi option is only available when lenders haven’t securitized the loan, according to Bankrate’s McBride. That typically includes local community banks or banks for ultra-wealthy clients. The option is also available to those with FHA, VA, USDA loans and conventional mortgages backed by Fannie Mae or Freddie Mac.

A Spike in US Mortgage Refinancing

Declining mortgage rates have led to an uptick in refinance applications

Source: Mortgage Bankers Association

Begin the Refinancing Process

If you have determined which type of refi works best for you, it’s time to kick off the refinancing process. It’s much like the mortgage application process, albeit simpler and shorter. (The average refi takes about six weeks to complete.) Let’s walk through the steps…

Gather the Necessary Financial Documents

A lender will likely ask to see your recent pay stubs, federal tax returns, bank and brokerage statements and more. Organizing your paperwork ahead of time will allow you to easily apply with different lenders and compare offers.

Borrowers should start by calling their current mortgage lender to get details about their existing mortgage and inquire about refi options. But don’t stop there: Research different lenders in your area or online to find the best deal. Bankrate’s McBride recommends filing refinance applications with three different lenders on the same day to get the most effective comparison. The most important number to evaluate? McBride said to look at the APR, known as the annual percentage rate, which incorporates the cost of the rate and the fees.

Accept a Refi Offer and Go Through Underwriting

Once a borrower submits their refinance application, the lender will begin the underwriting process. To ascertain your financial standing, a lender will run a credit check, ask you to disclose all your assets and liabilities and review your financial documents.

A mortgage refinance typically requires an appraisal to determine the property’s current market value. You will pay a professional appraiser to assess your home. Other lenders may appraise your home using a financial model, which can come at no cost to the borrower.

Lock or Float Your Interest Rate

Mortgage rates shift constantly, meaning the rate you’re initially offered could change during the application process. So once a borrower has an idea of the closing date, experts advise locking in the interest rate at that point and time. If you “float” the interest rate, you’ll have to settle on the market rate on your closing date whether it’s higher or lower. That’s why locking in a rate can provide security for those who want to know what they’re signing up for. You can typically lock in a rate for free if the closing is within 30 days; any longer can incur a fee. Lenders may also offer a “float-down option,” which lets borrowers access a lower rate should numbers trend in a favorable direction — for a fee.

Close on Your Refinance Loan

The final step of the refinancing process is closing. At least three days before the closing date, the borrower will receive a closing disclosure[4]. On closing day, you’ll meet a representative from the lender, sign loan documents and pay any closing costs that aren’t rolled into the loan.

More Than 3 Million Mortgages Could Benefit From a Refinance

Note: Snapshot of total US mortgages from July 2024 Source: CoreLogic

Whatever You Do, Don’t Do This…

What advice you should take can vary based on a person’s financial situation. But for those who follow any number of self-proclaimed personal finance gurus on TikTok, there are things you should be wary of.

Watch Mortgage Interest Rates, Not the Fed

Maybe you’ve heard about the Fed “cutting.” While the central bank’s actions certainly influence mortgage rates, Fannie Mae Chief Economist Mark Palim clarifies that there isn’t a “one-to-one connection.” In other words, mortgage rates don’t always change when the Fed moves. In fact, borrowing costs for a mortgage just ticked up after the Fed cut the benchmark rate.

While Fannie Mae forecasts that the average rate will fall to 5.7% by the end of 2025, Palim said borrowers should never try to time rates. “Leave that to the hedge funds,” he said. “Look at your personal budget and consider transaction costs. When it makes sense to you personally and economically, do it.”

WEG’s Smith warns homeowners to be mindful of how they use the money from a cash-out refinance. Some treat cash-outs like free money, using the funds for investments or personal purchases. But don’t forget: Cash-out refis increase your monthly payments and liability.

Borrowers may be tempted to refinance whenever they spot an advantageous rate drop. While the immediate savings may seem attractive, you risk elongating your payment period, increasing your principal and adding to your total interest payments — which could complicate your retirement plans or force you to make mortgage payments while on a fixed income.

“Sometimes you’re much better off with your current loan, but we all get lured by a lower payment,” Smith said.