Sales in the mid- and lower range swoon as many people who need a mortgage seem to be waiting for lower rates.

By Wolf Richter for WOLF STREET.

Still dogged by mortgage rates milling around in the 7% neighborhood, and by people’s urge to wait for lower mortgage rates before buying, sales of existing homes of all types – single-family houses, townhomes, condos, and coops – fell further in May from April on a seasonally adjusted basis, to an annual rate of 4.11 million homes, just a notch above the low points in late 2023 which had been the lowest since the depth of the Housing Bust in 2010, according to the National Association of Realtors today.

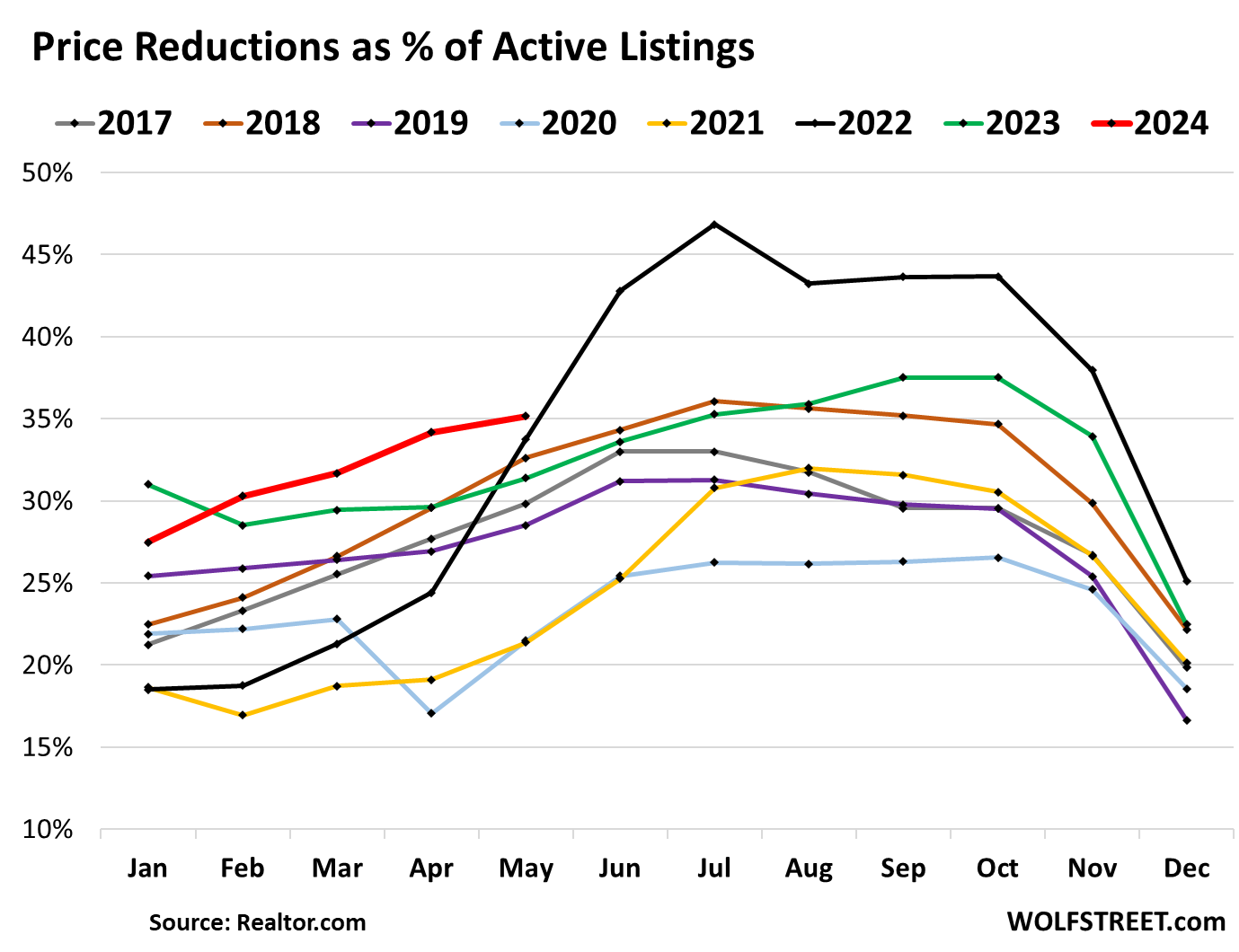

The drop in sales came even as supply and active listings jumped to multiyear highs, and as price reductions to active listings were the highest for any May in the data by Realtor.com going back to 2017. (historic data via YCharts):

But sales shifted massively to the higher end, while middle to lower end sales swooned, as the NAR pointed out, a change in mix that skewed the median price and pushed it higher (more in a moment).

Sales in May were down from the Mays in prior years:

- May 2023: -2.8%

- May 2022: -23.9%

- May 2021: -30.6%

- May 2019: -22.9%

- May 2018: -23.9%.

The 3% mortgage rates of yore are having the effect that these homeowners don’t want to buy another home, and they stay put. Because they don’t buy, sales are down. And because they therefore don’t put their current home on the market, inventory is down in equal measure. According to our estimates, the entire housing market may therefore have shrunk by about 20% because a large portion of homeowners with 3% mortgages are neither buying nor selling, and have vanished as demand, and have vanished in equal number as supply.

The average 30-year fixed mortgage rate has been between 6.5% and 7.5% since late 2022, reaching 7% in October 2022, according to the measure by Freddie Mac. In the latest week, mortgage rates averaged 6.87%. While that seems high after 14 years of interest-rate repression through 0% policy rates and QE that caused home prices to spike, those rates would have seemed like a pretty good deal during more normal times

Price reductions rose to 35% of active listings, the highest for any May in the data released by Realtor.com going back through 2017:

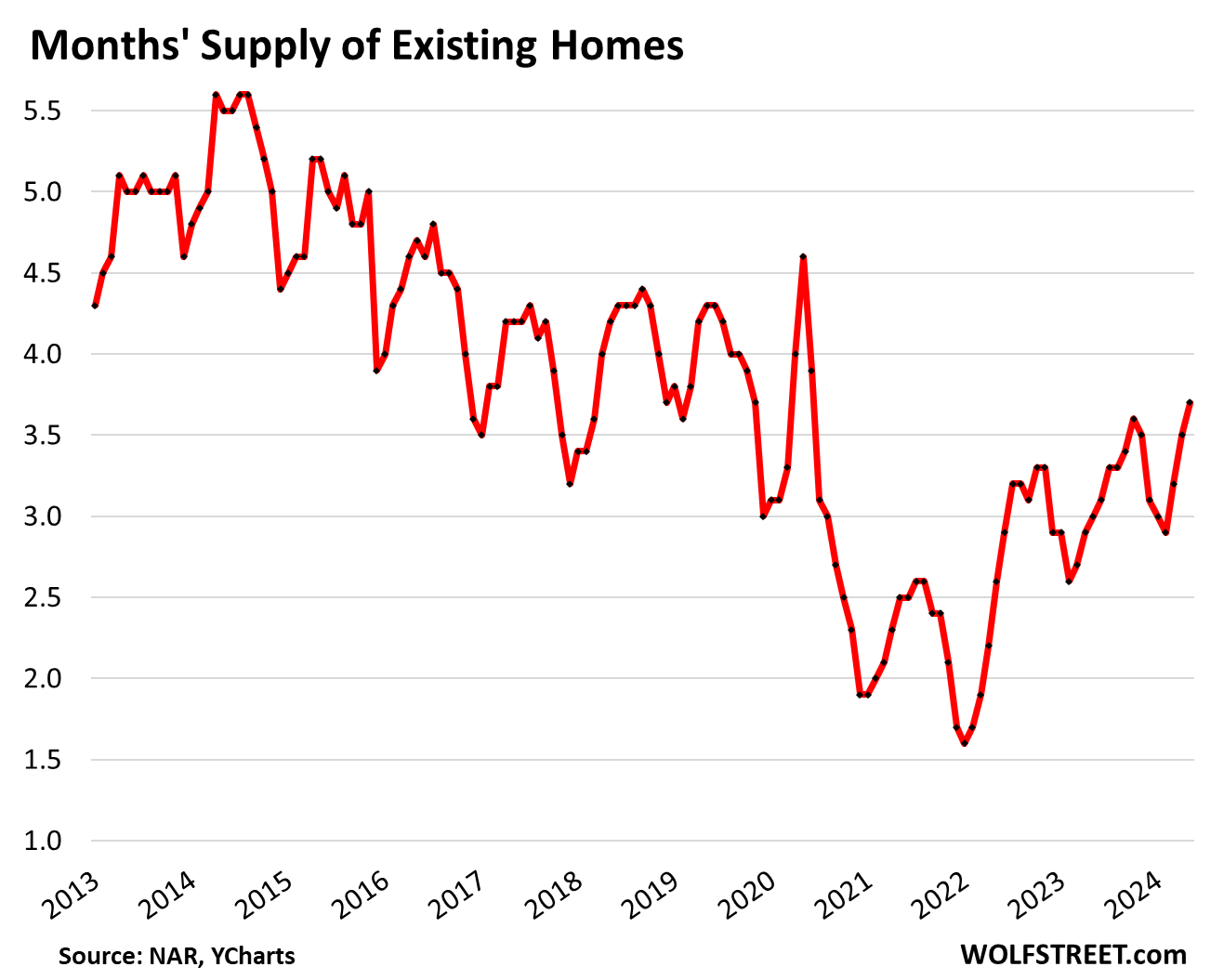

Supply jumped to 3.7 months, the highest since June 2020, as inventory for sale jumped by 18.5% year-over-year, to 1.28 million homes, according to NAR data, while sales were down 2.8% from a year ago, and by 20% to 30% from the Mays in earlier years.

Active listings surged to 788,000 homes, the highest since July 2020, and up by 35% from a year ago, according to data from Realtor.com, as more new listings came on the market amid very slow sales. Compared to May in prior years:

- May 2023: +35.2% (green)

- May 2022: +64.3% (black)

- May 2021: +76.0% (yellow)

- May 2019: -33.3% (purple)

- May 2018: -31.9% (brown)

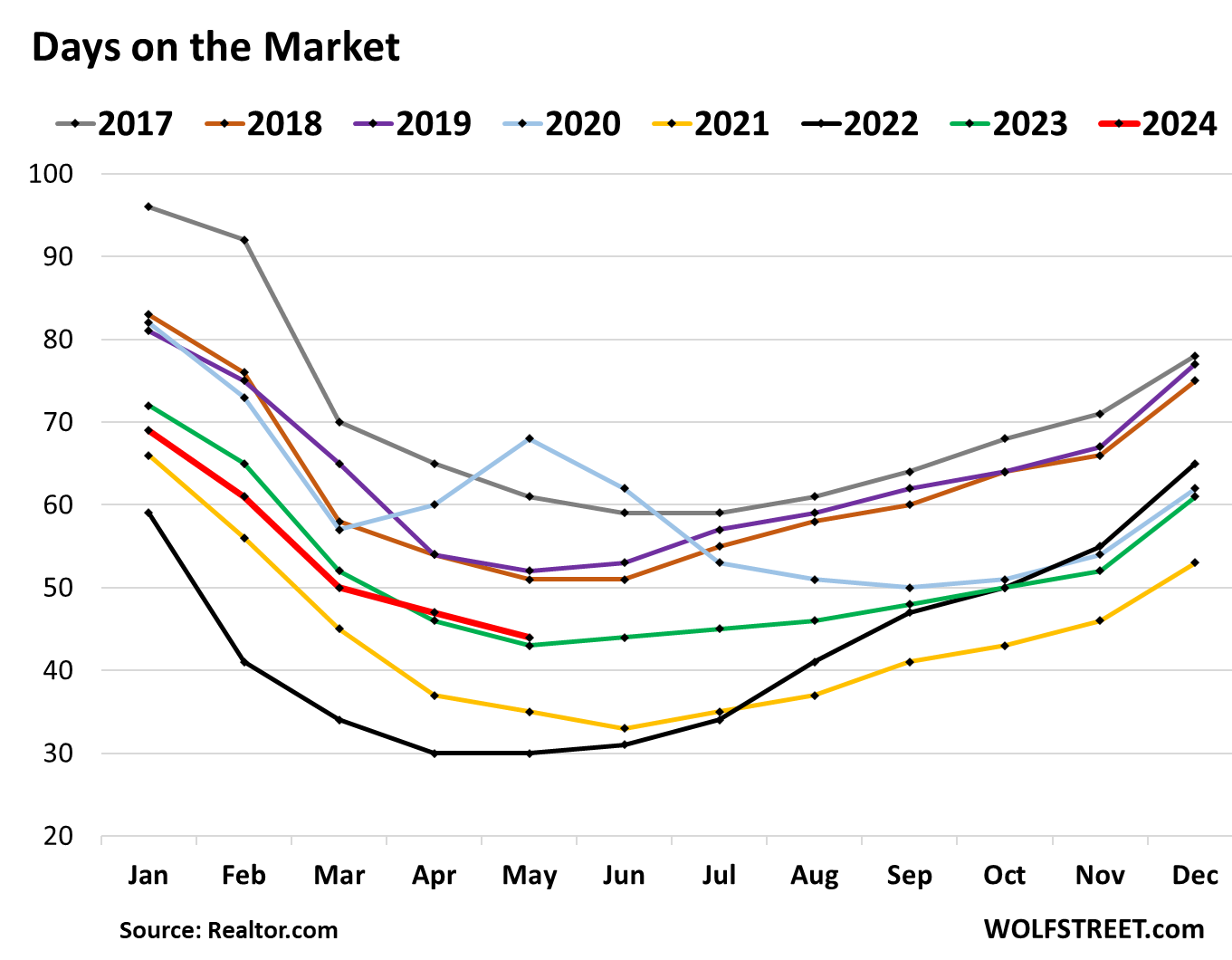

Days on the market – until the home is either sold or pulled off the market – at 44 days, was the highest for any May since 2020.

This metric is a function of two factors: How quickly a home sells, and how quickly it gets pulled off the market if it doesn’t sell (data via Realtor.com):

The median price was skewed by a surge in sales of higher-end homes.

According to the NAR, despite the overall decline in sales, the high end was hot:

- Sales of homes of over $1,000,000: +22.6% YoY

- Sales of homes of $750,000 to $1,000,000: +12.9% YoY

- Sales of homes of $500,000 to 750,000: +6.9%

- Sales of homes $250,000 to 500,000: +1.0%

- Everything below fell.

So the mix of homes that sold changed toward the higher end, with relatively fewer sales in the mid-range to lower-end homes.

The median price is the price in the middle. And this shift in mix of what sells toward the higher end pushes up the middle of the prices that sold, and thereby the median price. This is an infamous shortcoming of the median price. We discussed the mechanics, including a chart, of how median home prices are skewed by changes in the mix here.

The median price of single-family houses jumped to $424,500, amid that surge in sales of high-end homes that skewed the median price and shifted it higher (see our detailed discussion of how that works here). It eked out a new all-time high, up by 0.9% from the prior high in June 2022:

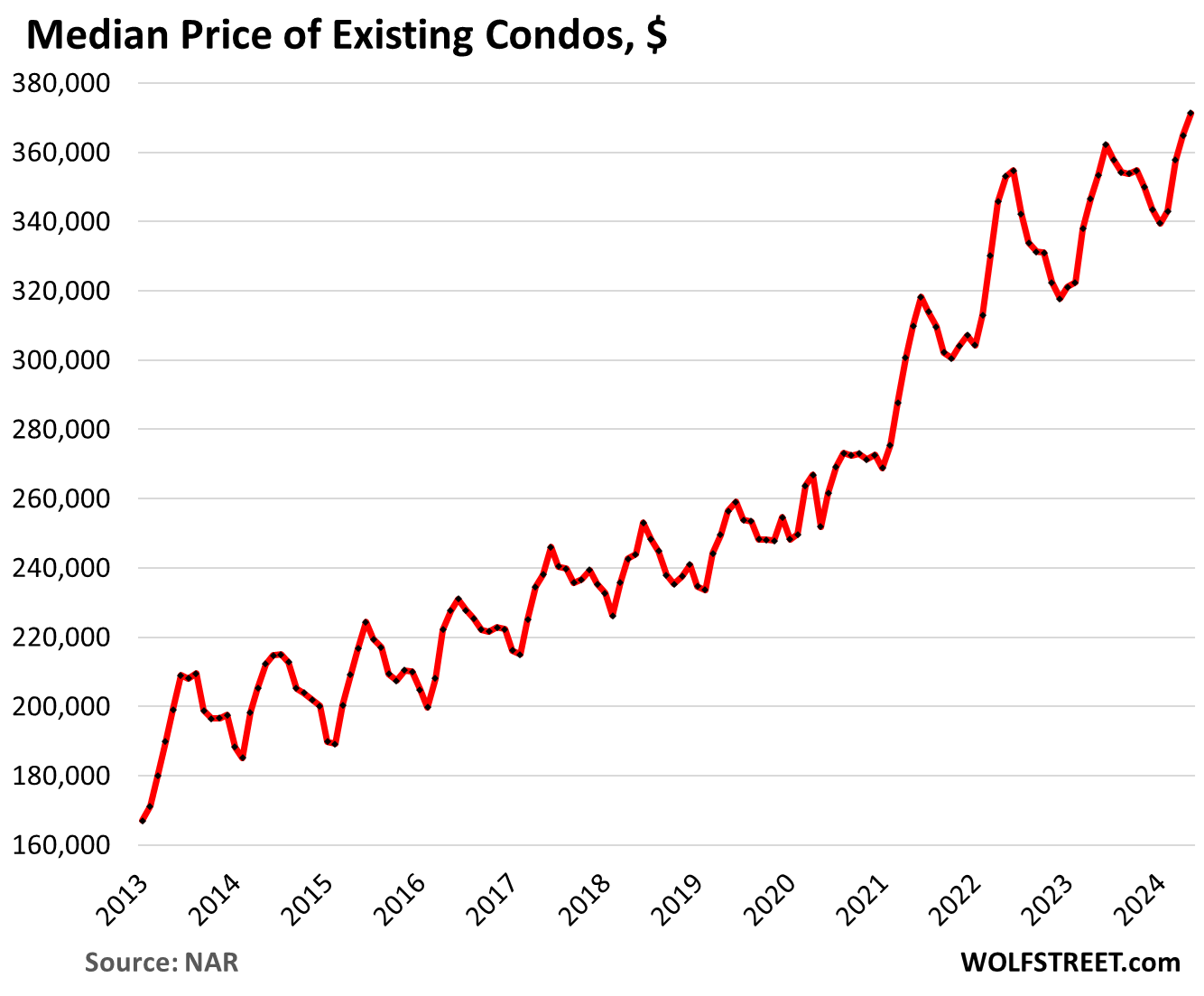

The median price of condos and coops rose to $371,300, a new record, amid similar shifts in sales to the higher end of condos:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()