A recent survey reveals that 51% of Americans have spent more money than they can afford to impress others, with a high trend among young people and men. The result of this behavior is dire, with many spiraling down financial whirlpools with no visible way out.

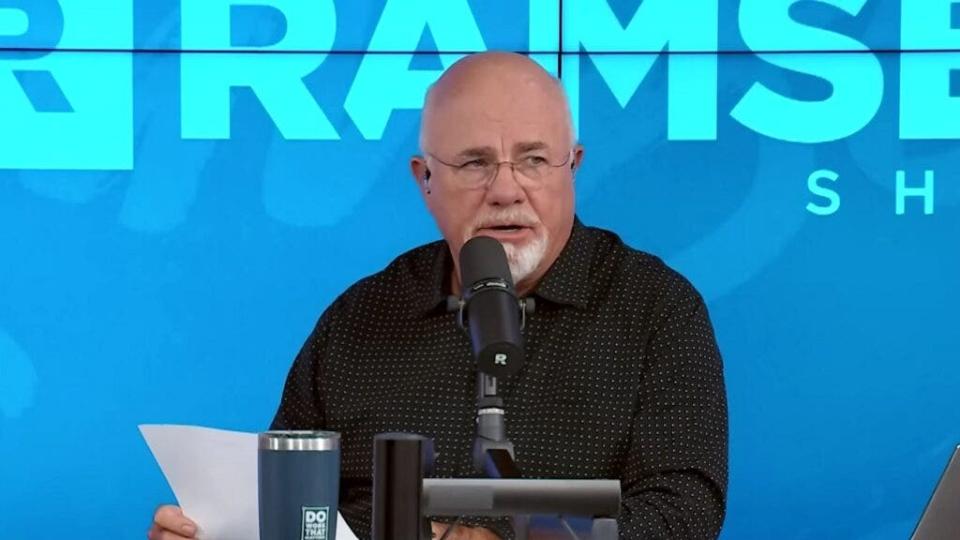

“Most people don’t have anything written down as a budget,” Ramsey said in an interview with TheStreet. “They don’t have any idea where their money’s going. When you start being intentional about that, it’s a self-awareness activity. Look at what we’re spending here on eating out.”

Don’t Miss:

He didn’t mince words when assessing the growing reliance on online shopping and frictionless spending. “Personal finance is about 80% behavior. It’s only about 20% math or head knowledge,” he said. “But what happens is that we start spending money we don’t have. We feel trapped like we must keep up – or keep repeatedly hitting the Amazon Prime button and buying extra stuff.”

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

The basis of Ramsey’s advice can be summed up with one word: awareness. He reflected on his own experience and shared, “One of the things that happened to me in my 20s is I was broke and lost everything. Through that experience, I looked in the mirror and found the problem: me. I was the idiot. I was the problem.”

But Ramsey’s message wasn’t all negative. He emphasized that people can control their financial futures. “The good news is that I also found the solution. I can change it tomorrow. I can decide. I’m not spending money I don’t have anymore,” he said.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

The reality of overspending is even more concerning when juxtaposed with findings from McKinsey, indicating that while personal income has risen, consumers are planning to cut back on discretionary purchases due to shrinking disposable income. Yet dining out is a significant splurge category for many.

“One guy sitting in one of our groups said, ‘I think I found out why we don’t have any money in retirement when we did our budget. I think we’re eating it,'” Ramsey recounted. “And that’s exactly right. They’re going out to eat every night.”

Trending: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

Ramsey made it clear that he’s not opposed to dining out. “I love restaurants,” he said. “But you can’t go out to eat every night if you’re broke. So again, all of these things are about self-awareness.”

The clear warning signs have not deterred many Americans from living beyond their means. Statistics reveal that half U.S. adults carry credit card debt from month to month – a burden that often feels insurmountable.

Ramsey isn’t shy about dishing out a good dose of tough love, insisting that most of the time, it’s just the approach needed to jolt people into action. “People call it tough love, but it’s just that I love you enough to tell you the truth and nobody else will,” he said. “And sometimes, that sounds harsh to people, but it’s not harsh. I care deeply that you get that.”

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Warns: The One Money Error You’re Making That Could Derail Your Financial Future originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.