Marvell Technology has jumped almost 50% since its August lows on the back of improving sales figures for the semiconductor industry. Some fundamental changes in the stock could make it the perfect candidate for an extended bull rally.

Marvell is a fabless semiconductor company that sells data infrastructure solutions. Its equipment is essential for data center operations, enterprise networks, and the automotive industry.

The company makes high-performance processors for cloud computing as well as networking equipment that is essential for connectivity and security across different networks.

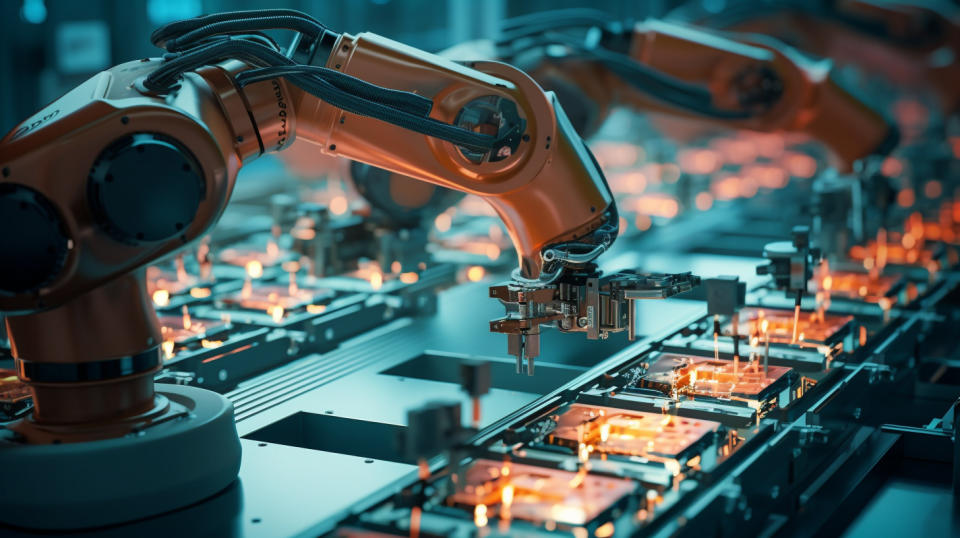

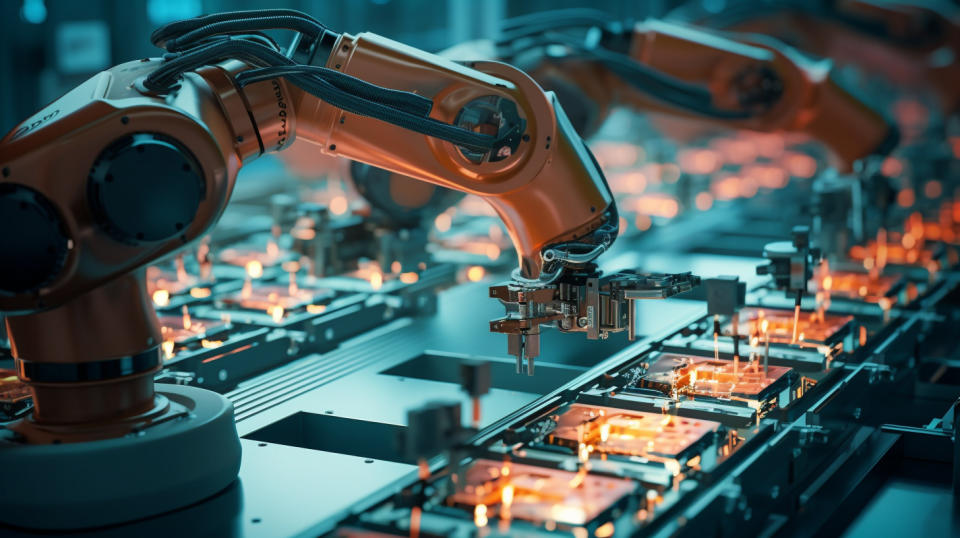

A high-tech production line of robotic arms assembling a semiconductor chip.

MRVL is also an essential part of the automotive industry, offering semiconductor products for software-defined vehicles.

As a result of these services and products, MRVL serves businesses globally, though its business is dominated by big tech customers like Amazon Web Services (AWS), Alphabet, and Microsoft. Its automotive industry customers are also spread across the globe but some of its main customers include BMW, Volkswagen, and Daimler.

Marvell Technology’s bull thesis is all about the big tech. As these companies scale their AI projects, Marvell stands to benefit. However, AI rallies have inflated the valuation of many tech companies and despite announcing impressive quarterly results, companies are failing to meet some of Wall Street’s high AI expectations.

In such a scenario, Marvell finds itself in an interesting position. The company’s management believes that its carrier infrastructure and networking equipment segments may have bottomed in terms of demand. It expects a recovery in the latter half of the year, with analysts keeping a close eye on the $2 billion in revenue mark from the non-AI segment.

If this mark is achieved, it would add another trigger to the stock’s upside. We believe that along with the AI potential, the non-AI segment’s revenue could showcase a healthier company, increasing investor confidence triggering a series of analyst upgrades, and improving investor sentiment.

Marvell is not on our latest list of the 31 Most Popular Stocks Among Hedge Funds. As per our database, 74 hedge fund portfolios held MRVL at the end of the second quarter which was 87 in the previous quarter. While we acknowledge the potential of MRVL as a leading AI investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as MRVL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article was originally published at Insider Monkey.