Cheniere Energy Inc. (NYSE:LNG), founded in 1996 by Charif Souki, was created as an oil and gas exploration company, but is now a dominant player in the midstream liquid natural gas market. GuruFocus assesses this stock as trading marginally above its GF Value of $141.22; however, the stock appears to be a bargain when assessed by its discounted cash flow valuation with an 11% discount rate. GuruFocus’ overall GF Score is 84 out of 100 and analysts are predicting a one-year price target of approximately $200 per share and are forecasting aggressive growth through 2030.

As of this writing, the company has a return on invested capital of over 38% and an astounding return on equity of over 280%, though these metrics have been marked by significant fluctuations over the past 20 years. Return on assets rose significantly during 2023 and is currently over 23%. Revenue and earnings are expected to drop this year, but will increase in 2025.

Cheniere Energy’s relationship to Cheniere Energy Partners

Cheniere Energy Partners L.P. (NYSE:CQP) was formed from Cheniere Energy as a separate legal entity in 2003 to manage specific aspects of the Sabine Pass Liquefaction (SPL) facility, a natural gas liquefaction and export facility located in Cameron Parish, Louisiana. Cheniere Energy owns a controlling stake in Cheniere Energy Partners, while Brookfield Asset Management (NYSE:BAM) and Blackfield Infrastructure Partners have approximately 48% of the partnership. The separate partnership has allowed Cheniere to specifically raise capital and manage risks associated with the SPL facility project. Cheniere Energy divides marketing fees generated from Sabine Pass gas with Cheniere Partners using a 20/80 split. Proceeds from marketed gas at Corpus Christi terminals flow exclusively to Cheniere Energy. Additionally, while Cheniere Energy receives only a portion of the cash flows from Sabine Pass LNG terminals due to its partial stake in Cheniere Partners, it retains 100% of the cash flows generated by Corpus Christi terminals.

From an investment perspective, Cheniere Energy Partners operates as a master limited partnership that is taxed like a private partnership while still allowing access to Cheniere Energies’ liquidity. MLPs are not corporations, but trade on national exchanges. Instead of shares in a company, investors buy units in the partnership and are referred to as limited partners versus managers who are considered general partners of the entity. The MLP passes taxes to investors who can defer tax payments on distributions until the units are sold. For these reasons, investors may elect to keep these investments in taxable accounts.

U.S. LNG market

The midstream natural gas industry is characterized by high barriers to entry due to high capital costs and stringent regulations to build out infrastructure. Many projects take 10 years or more to become operational. Consequently, companies in the industry tend to reflect high debt ratios. There has been a trend toward consolidation in the industry in recent years with companies like Energy Transfer LP (NYSE:ET), Enterprise Products LP (NYSE:EPD) and Targa Resources (NYSE:TRGP) merging with smaller companies.

Cheniere Energy was the first U.S. LNG exporter when in 2016 it exported a tanker load of liquid natural gas from the Sabine Pass terminal to Brazil. Since that time, many suppliers have entered the LNG production and export space, including integrated mega caps like Shell (NYSE:SHEL), Chevron (NYSE:CVX) and Exxon (NYSE:XOM); other midstream players like Kinder Morgan (NYSE:KMI) and The Williams Companies (NYSE:WMB), and smaller startups like Tellurian (TELL), which ironically was founded by Souki after he was ousted by Cheniere’s board before the company’s pioneering 2016 LNG shipment.

According to industry analyses, U.S. energy production in the United States currently is near all-time highs due to several factors:

-

Sustained price of oil above $70 per barrel throughout the past year has incentivized increased production.

-

Improved efficiency among energy companies has resulted in rising oil extraction despite a decline in the number of active rigs.

-

Boosted demand for natural gas due to the ongoing conflict in Ukraine and sanctions by the European Union against Russia, driving European customers to seek alternative suppliers.

The U.S. became the largest LNG exporter in 2023 due to Europe’s increased reliance on non-Russian suppliers. This led to an oversupply of LNG in the global market, which suppressed prices and triggered the attention of environmental groups concerned about terminal safety and emissions. In response, the Biden administration announced a pause on pending LNG export decisions to non-Free Trade Agreement countries in January 2024. Although this decision is a headwind for the general U.S. LNG export industry, it presents an opportunity for Cheniere Energy to capture additional market share since the company has achieved final investment decisions on several export projects as compared to competitors. In response to the pause in LNG export decisions, many LNG midstream companies are using capital to pay down debt and repurchase outstanding shares to increase shareholder value.

Also, on the U.S. regulatory horizon is HR1, the Lower Energy Costs Act, which was passed by the House of Representatives on March 30, 2023. If this bill becomes legislation, the U.S. Department of Energy’s role in approving LNG export terminals will be eliminated.

Globally, the U.S. LNG export business competes with other exporting countries, including Qatar, Australia and West Africa. The U.S. has higher gas costs when compared to Qatar and West Africa. Furthermore, the U.S. is at an economic disadvantage when transporting to China and Japan, which are expected to play key roles in the LNG export market in the next few years. The market is expected to wane in the coming years, but this may present an opportunity for Cheniere Energy to capture additional market share.

Cheniere Energy’s position in the LNG market

Cheniere Energy’s first-mover advantage and its focus and experience as a niche midstream LNG provider have enhanced its reputation to reliably provide LNG services on time and within budget, unlike many of its competitors. This has allowed the company to develop cost efficiencies and powerful contract negotiation abilities. Cheniere’s contract coverage is its main competitive advantage. The company, unlike the general market, can negotiate long-term contracts with fixed rate pricing and fee structures that do not allow price or destination revisions similar to other competitors’ contracts linked to Henry Hub pricing.

Competitive playing field

For purposes of this analysis, I examined the fundamentals of Cheniere Energy against Cheniere Energy Partners and three other U.S. midstream players that engage in LNG production, storage and export as of March 22.

|

Company |

Cheniere Energy |

Cheniere Energy Partners L.P. |

Energy Transfer L.P. |

Kinder Morgan, Inc. |

The Williams Companies |

|

Market Cap (Billions) |

37.49 |

23.89 |

50.30 |

40.08 |

46.61 |

|

Revenue (Billions) |

20.39 |

9.66 |

78.59 |

15.33 |

10.91 |

|

FCF Yield % |

16.80 |

12.09 |

12.28 |

10.34 |

7.23 |

|

Earnings Yield % |

26.36 |

14.08 |

6.63 |

5.97 |

6.81 |

|

ROIC % |

38.75 |

27.98 |

7.61 |

5.26 |

8.18 |

|

ROE % |

282.80 |

428.95 |

11.27 |

7.80 |

26.60 |

|

ROA % |

23.70 |

30.80 |

3.18 |

3.40 |

6.30 |

|

Buyback Yield % |

4.26 |

Not Available |

-1.83 |

1.06 |

0.00 |

|

Total Return % |

5.35 |

Not Available |

6.27 |

7.32 |

4.96 |

Energy Transfer is a diversified midstream MLP that provides pipeline and terminal storage services for crude oil, natural gas liquids and refined products in addition to natural gas.

Energy Transfer’s focus on LNG is primarily driven by its Lake Charles LNG import and regasification facility. In 2019, in cooperation with Shell, the MLP began to convert the facility to an LNG export facility. Energy Transfer has signed several long-term sale and purchase agreements with global energy companies, including China-based ENN Holdings Limited and China Gas Holdings Ltd. (HKSE:00384), Singapore-based Gunvor Energy, Korea-based SK Gas Trading LLC and Shell Energy North America.

Despite these long-term agreements, the Lake Charles project has faced several hurdles. Energy Transfer was forced to restructure the LNG project in March 2020 as Shell announced a decision to withdraw equity investment. Furthermore, the project had not reached FID when the Biden administration enacted its pause on exports, so its efforts have essentially been stalled until the pause has been lifted.

Kinder Morgan’s offerings are also broader than those of Cheniere Energy and focus on other energy areas consisting of refined, renewable products and carbon dioxidein addition to LNG. Liquid natural gas falls into the company’s natural gas business, which generates 64% of its cash flows. The company expanded LNG efforts with the acquisition of Kinetrex Energy for $300 million in 2021, which includes services in renewables as well as LNG. Kinder Morgan’s LNG assets include two LNG production and fueling facilities (LNG North and LNG South) and two LNG export projects (The Elba Liquefaction Company joint venture and Gulf LNG). With these assets, Kinder Morgan produces less than half the capacity that Cheniere Energy does.

Williams Companies mainly focuses on the storage and transport of liquid natural gas, but is also exploring the renewables market. Its LNG efforts are directed toward building out its Transco corridor. In January, the company completed its $1.95 billion acquisition of natural gas storage assets from Hartree Partners LP, which included six underground storage facilities in Louisiana and Mississippi with strategic connections to its Transco pipeline. The Williams Companies has six active LNG export facilities, five LNG projects under construction and eight pre-FID LNG projects that have been permitted.

Income challenges and capital allocation

Cheniere Energy has a strong moat and niche focus; however, investors should be aware the company is forecasted for a reduction in both revenue and earnings per share in 2024. The pause on LNG export project approval will also heavily affect the company due to its high reliance on LNG export projects even though it has an advantage over other companies with projects that have not reached FID.

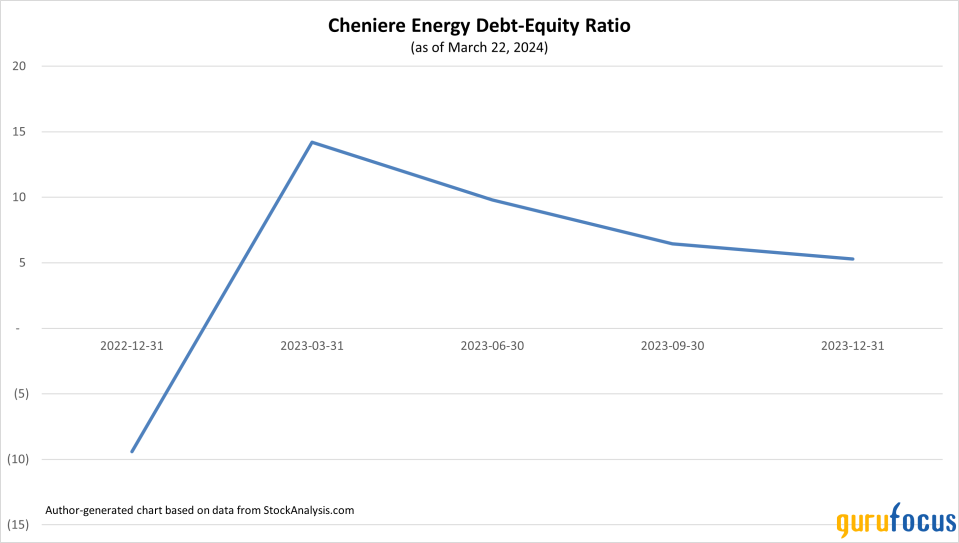

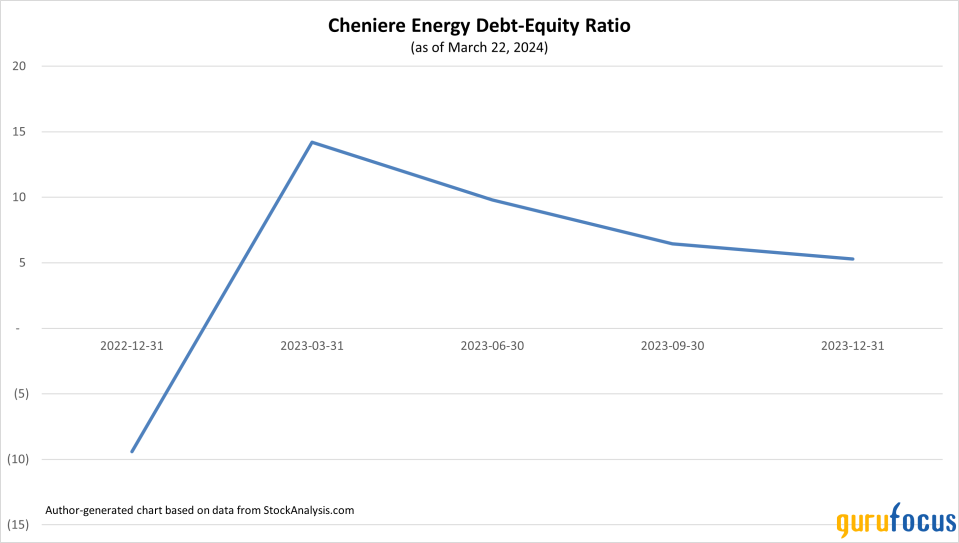

The company incurred net losses in 2020 and 2021, which it attributed mostly to changes in fair value from commodity derivatives. Cheniere also began to reduce its enormous debt burden, which it has aggressively continued to do throughout 2022 and 2023. Cheniere Energy has had a long history of negative debt-to-equity ratios, which may dissuade conservative investors. It still has debt-to-equity ratios that rank worse than at least 90% of its peers, which may be a concern to investors; however, its ability to generate solid operating cash flow may offset those concerns. As of this writing, Cheniere’s estimated weighted average cost of capital is 4.58% versus return on invested capital of 33.09%.

Unlike many of its peers, Cheniere Energy has only been paying dividends since the fourth quarter of 2021. The company has been consistently increasing dividend payments since that time, yet its current annual payout ratio is at a conservative 4% versus those of its peers listed above, which range from 68% to 112%. Dividend payouts may be a reason the share price has risen by 138% and is forecasted to since that time. The company’s current capital allocation strategy appears sound despite its history.

Conclusion and future outlook

Cheniere Energy is an attractive investment opportunity for aggressive energy sector investors due to its first-mover advantage and focused market-leading position in the LNG export business. Midstream LNG companies are characterized by high capital costs, high debt levels, stringent regulations and lengthy project timelines. Despite these hurdles, the U.S. LNG export business boomed during 2023, due in part to demand in Europe from EU sanctions on Russian imports because of the conflict in Ukraine. The industry is facing headwinds due to the recent pause by the Biden administration on the approval of LNG export projects to non-Free Trade Agreement countries that have not reached FID. This is a mixed blessing for Cheniere Energy’s business as it is primarily focused on LNG storage and transportation, but also has a well-entrenched network of not only FID projects but active projects that are generating revenue.

In response, many industry players are taking this opportunity for slowed growth to pay down debt and repurchase shares, enhancing shareholder value. Industry demand is expected to drop until 2027, but this suppressed demand may present an opportunity for Cheniere Energy to capture additional market share. Conservative investors may want to heed Cheniere’s fluctuating debt and return metrics before making an investment decision.

Please note that I am not a financial advisor, and this article is intended only for informative purposes and should not be construed as investment advice.

This article first appeared on GuruFocus.