A US court has convicted a Mozambican former finance minister over a 10-year-old conspiracy that triggered the worst economic crisis in his home country since independence.

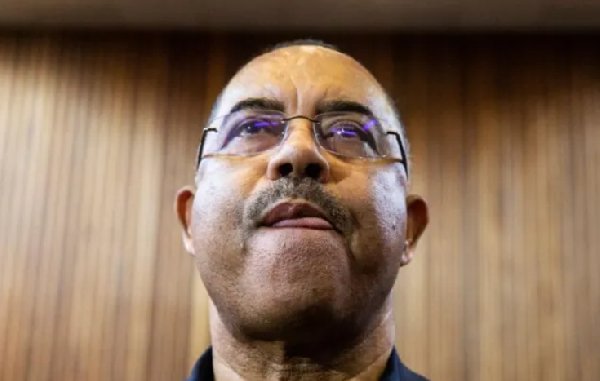

Manuel Chang was found guilty of accepting pay-offs through US banks for approving secret loans.

The loans were intended to pay for a fleet of tuna fishing ships and other projects, leading to the affair being dubbed the “tuna bond” scandal. But the loans were plundered, leaving Mozambique $2bn (£1.5bn) in debt.

Chang was arrested in South Africa in 2018, and extradited to the US the following year to face fraud and money-laundering charges.

The Mozambican authorities had wanted Chang to be sent back to be tried on home soil, instead of in the US.

He will be sentenced later, potentially facing 20 years in prison. Chang had denied the charges and his lawyers say he plans to appeal the verdict.

Analysts say it is one of the biggest corruption cases seen on the African continent.

How the “tuna bond” scandal unfolded

Ten other people have been imprisoned in Mozambique over the scandal, including the son of then-President Armando Guebuza.

The loans were issued by Credit Suisse and the Russian bank VTB and guaranteed by the Mozambican government.

But some of these loans were not disclosed and were signed off by Chang during his term as finance minister between 2005 and 2015.

The court in New York heard that Chang had pocketed $7m in bribes from the shipbuilding firm Privinvest, but his lawyer said there was no evidence Chang had received “a single penny” and said the projects were approved former President Guebuza and other ministers.

But in her closing arguments on Monday, the prosecuting assistant US attorney Genny Ngai said Chang had personally “signed all of the loan guarantees… and he was critical to the loans being approved”.

“He cared about money over his position,” she told the court. Previously, three former Credit Suisse bankers pleaded guilty to US charges of money laundering over the “tuna bond” case. In late 2021, UK authorities fined the investment bank $178m over the scandal.

The fine was part of a $475m settlement with UK, Swiss and US regulators. As a result of the fraudulent deal, “a couple of million people were thrown into poverty” and “several billion dollars [was] knocked off economic growth,” Richard Messick, who writes the Global Anti-Corruption Blog, told the BBC.

Missing funds to the tune of £500m were siphoned off, according to an independent audit that was ordered by the International Monetary Fund who later withdrew their support from Mozambique. It is still not known what happened to that money.

Mozambique is rich in natural resources – thanks to large offshore gas reserves, ruby mines and more. Its economy has grown steadily in recent years but it still ranks as one of the poorer nations on the African continent.

In a statement on Thursday, the US attorney for the Eastern District of New York, Breon Peace, said: “Today’s verdict is an inspiring victory for justice and the people of Mozambique who were betrayed by the defendant, a corrupt, high-ranking government official whose greed and self-interest sold out one of the poorest countries in the world.”