Latin America and the Caribbean (LAC) face significant vulnerability to the impacts of climate change. Several factors drive this vulnerability, including their geographic location; limited capacity to adapt to climate change; fragile, commodity-based economies susceptible to extreme weather-related disruptions; and the increasing frequency, intensity, and duration of those events. As global emissions and average temperatures continue to rise, climate change impacts on the region’s economy, infrastructure, ecosystems, and human well-being are becoming increasingly challenging. Average annual climate-related damages in LAC have reached US$11 billion, straining fiscal resources, and are forecasted to surge to US$100 billion by 2050, as highlighted by the Inter-American Development Bank (IDB).

[1]

The region could also face a 3.3% decline in GDP by 2030

[2]

caused by a climate-induced ecosystem collapse. Each occurrence of a climate-related disaster results in a 0.8% to 0.9% rise in fiscal deficits, due to an increase in expenditures and a reduction in tax revenues.

[3]

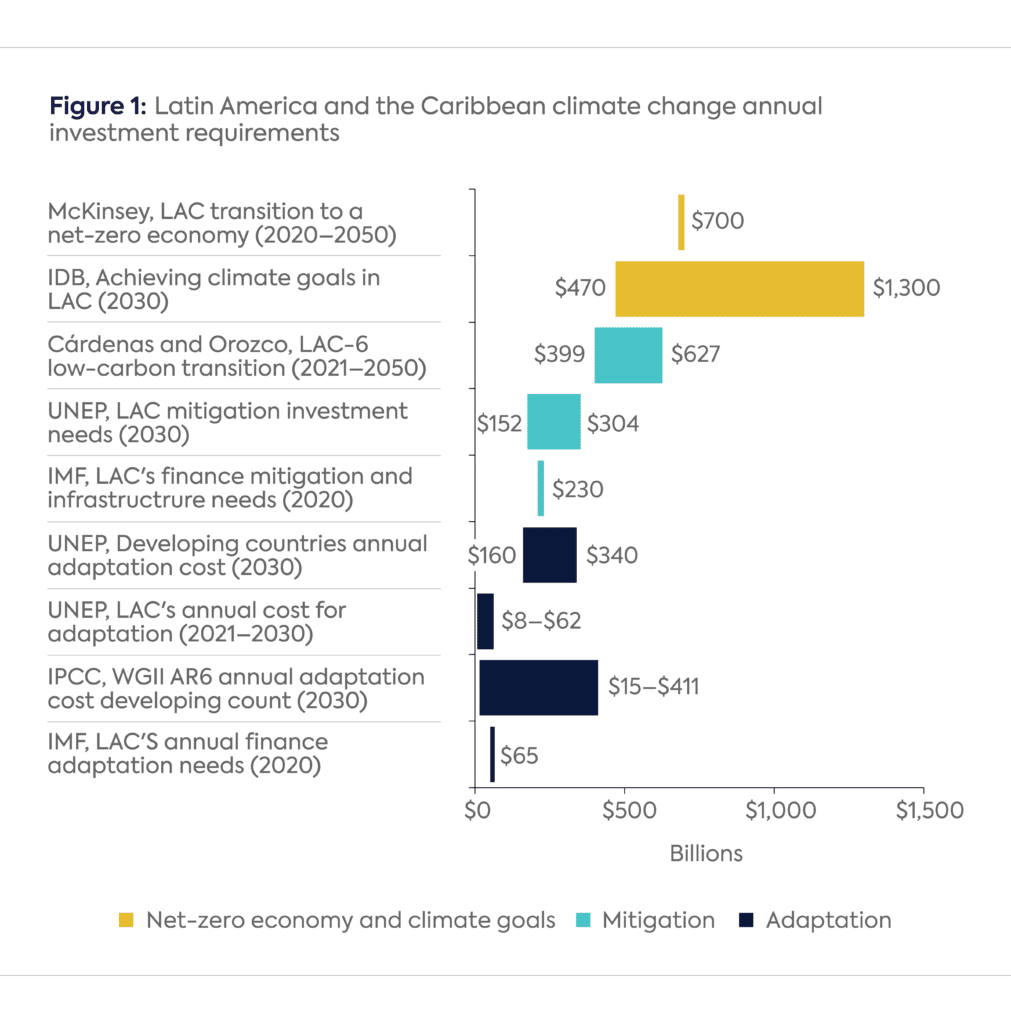

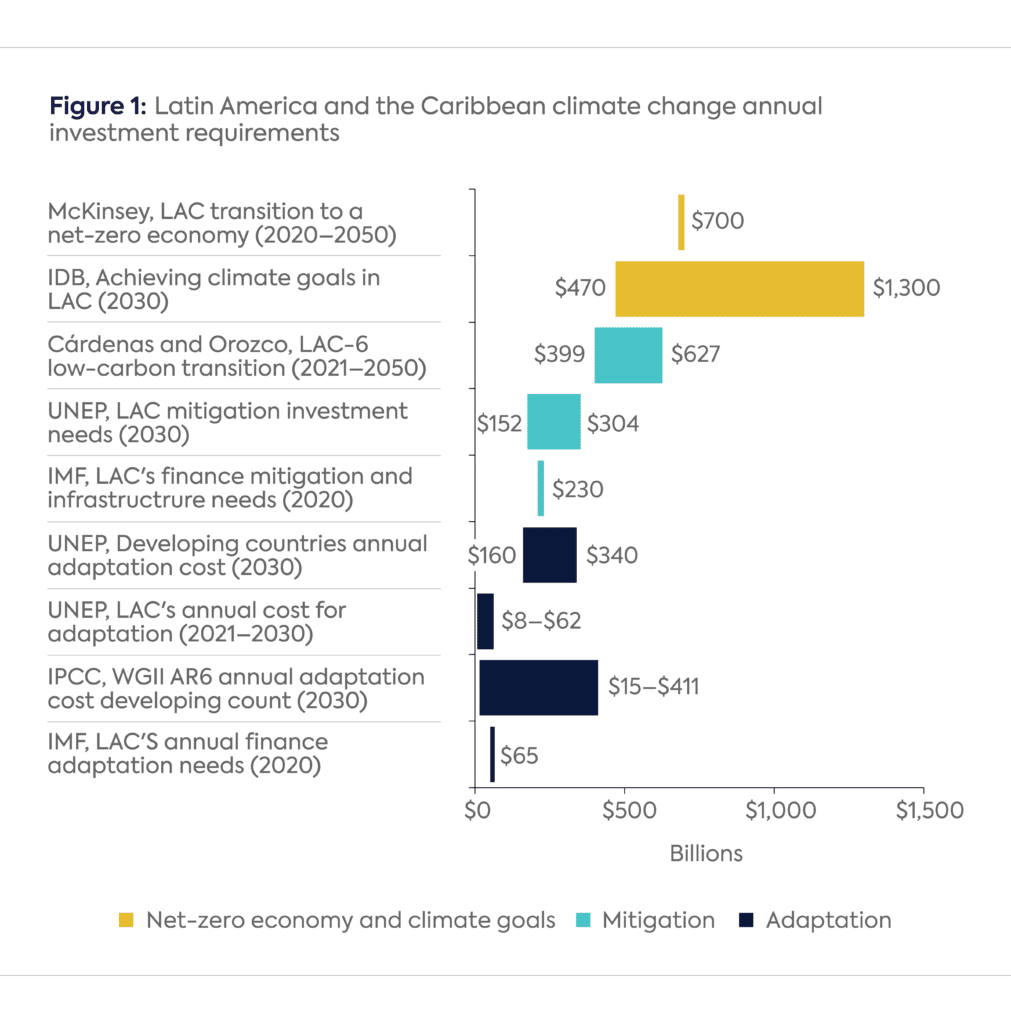

LAC’s vulnerability to climate change is exacerbated by the lack of investment in mitigation and adaptation. Annual climate-related financial needs in the region vary significantly depending on the source (see Figure 1), and averages range between US$228 billion

[4]

and US$513 billion

[5]

for mitigation, while annual adaptation flows range from US$65 billion

[6]

to US$250 billion

[7]

. According to the authors’ research comparing diverse studies, the region is only investing between 15% and 31% of what is necessary for mitigation and just an average of 7% in adaptation requirements.

Source: Authors’ elaboration with data from different sources

[8]

These low figures reflect a wider problem. Just one-third of emerging markets and developing economies (EMDEs) have translated their energy transition objectives into precise investment needs, underscoring the importance of strengthening capacities to accurately measure financing needs.

[9]

To help address this problem and to support and accelerate climate action, directly or through other government entities and stakeholders, finance ministries (FM) could lead and coordinate economic strategy and fiscal policy, regulate the financial system, and allocate government expenditure.

Traditional Budgetary Instruments

For starters, FM must participate in the development of national climate plans. FM could assess the financial requirements for climate action and efficiently allocate resources, taking advantage of their strategic role in tax and expenditure decision-making. In the short term, FM could implement green budgeting to strategically allocate resources for climate change mitigation and adaptation. This entails integrating expenditure planning on mitigation and adaptation measures, ensuring alignment with national climate goals, and optimizing resource utilization. In the medium term, FM could consider adopting green tagging, which involves labeling individual projects or expenditures based on their environmental and climate impact, thereby enhancing transparency and accountability in budget execution.

Moreover, medium-term fiscal frameworks (MTFF), which generally cover 5–10 years, should be fully aligned with climate change mitigation and adaptation plans and strategies. MTFF serve as unique tools to increase funding for climate change needs, while enhancing stability and improving planning for necessary investments. MTFFs should reflect multiyear budgetary commitments to specific line-items, programs, and projects. These commitments are essential for attracting private investment. Multiyear budgetary commitments should be irrevocable and enforceable, so that they can be used as collateral.

Taxes and Subsidies

For many LAC countries to reach their climate goals, FM will likely need to phase out fossil fuel subsidies while increasing tax and direct subsidies for renewable energy. In 2022, governments in LAC provided fossil fuels subsidies equivalent to 0.57% of GDP, or nearly USD$0.5 trillion.

[10]

However, the process of phasing out fossil fuel subsidies cannot happen abruptly. FM must gradually intervene to depoliticize energy pricing and implement mechanisms to support low-income families, such as cash transfers or social tariffs to prevent additional economic hardship. In addition to removing costly energy subsidies, one cost-efficient method to achieve climate goals is the adoption of carbon pricing. Carbon pricing, which requires certain entities to pay for their carbon dioxide emissions, diminishes economic incentives for fossil fuels, thereby increasing the attractiveness of new technologies that utilize low-carbon or zero-emission fuels. While the feasibility of its implementation varies depending on the political and economic circumstances of each country, FM could initiate the process of at least considering shadow carbon prices in all public expenditure decisions, meaning that even in the absence of an explicit carbon price, governments can incorporate in their budgetary decisions the direct costs associated with carbon emissions in their own expenditures.

Green Taxonomies, SOE Frameworks, and Insurance

FM also have the authority to implement regulations that encourage or mandate financial institutions to factor climate-related risks and opportunities into their decision-making processes. Green taxonomies serve as clear and straightforward example of mechanisms that FM can use to shape regulations in favor of investments and climate action, increasing private and multilateral sectors’ interest in participating in the market and accessing fiscal incentives and subsidies. Moreover, thematic bonds provide a strategic source of financing to achieve net zero goals and a climate-resilient transition. However, FM must assess institutional and regulatory conditions to issue such bonds. The region has not issued many thematic bonds due to several challenges, including a preference for issuing bonds in local currencies to mitigate exchange rate risk, which may not appeal to all foreign investors; regulatory barriers hindering foreign investors’ access to domestic markets; and underdeveloped and illiquid domestic debt markets.

[11]

Another strategic mechanism for FM to enhance climate finance efforts is through state-owned enterprises (SOEs). SOEs often possess the autonomy, resources, and capabilities to undertake climate action initiatives that extend beyond the limitations of national governments. Implementing comprehensive frameworks for evaluating projects’ environmental and social impacts will lead to meaningful contributions to political decision-making and prevent investments that do not align with national climate plans.

Additionally, when considering diverse impacts of extreme weather events, FM must incorporate financial insurance to help finance recovery, seeking to protect already scarce government resources to address these events. One example is the Caribbean Catastrophe Risk Insurance Facility, a multicountry risk pool that provides parametric insurance to Central America for rapid payouts following damages from extreme weather events.

[12]

Likewise, FM will be crucial in ensuring intergovernmental coordination, as well as facilitating investments by subnational governments.

The general principles discussed in this blog post, as well as others, would need to be translated into actionable short-, medium-, and long-term strategies. Implementation of each potential action will depend on each country’s capabilities and overall coordinating capacities, but, where possible, would give LAC FM greater opportunities to enhance their leadership, collaboration, impact, and vision for achieving climate goals.

Notes

Estefanía Jiménez and Gloria Visconti, “A Transformative Approach: IDB and GCF Partnership for Climate Action in Latin America and the Caribbean,” IDB blog Sostenibilidad, February 2, 2023, https://blogs.iadb.org/sostenibilidad/en/a-transformative-approach-idb-and-gcf-partnership-for-climate-action-in-latin-america-and-the-caribbean-2/#:~:text=Our%20estimates%20indicate%20that%20damage,urgent%20for%20and%20from%20everyone.

J. Johnson et al., The Economic Case for Nature: A global Earth-economy model to assess development policy pathways, World Bank Group, 2021, https://openknowledge.worldbank.org/server/api/core/bitstreams/9f0d9a3a-83ca-5c96-bd59-9b16f4e936d8/content.

R. Delgado, H Eguino, and A. Lopes, “Política fiscal y cambio climático: experiencias recientes de los ministerios de finanzas de América Latina y el Caribe,” IBD, 2021, https://publications.iadb.org/es/politica-fiscal-y-cambio-climatico-experiencias-recientes-de-los-ministerios-de-finanzas-de-america.

UNEP, “The Closing Window: Climate crisis calls for rapid transformation of societies,” Emissions Gap Report 2022, https://www.unep.org/resources/emissions-gap-report-2022.

M. Cárdenas and S. Orozco, “Climate Mitigation in Latin America and the Caribbean: A Primer on Transition Costs, Risk, and Financing,” Center on Global Energy Policy, Columbia University, November 21, 2022, https://www.energypolicy.columbia.edu/publications/climate-mitigation-latin-america-and-caribbean-primer-transition-costs-risks-and-financing/.

International Monetary Fund, Global Financial Stability Report: Navigating the High-Inflation Environment, October 2022, https://www.imf.org/en/Publications/GFSR/Issues/2022/10/11/global-financial-stability-report-october-2022.

UNEP, “Too Little, Too Slow: Climate adaptation failure puts world at risk,” Adaptation Gap Report 2022, https://www.unep.org/resources/adaptation-gap-report-2022.

International Monetary Fund, Global Financial Stability Report: Navigating the High-Inflation Environment, October 2022, https://www.imf.org/en/Publications/GFSR/Issues/2022/10/11/global-financial-stability-report-october-2022; UNEP, “Too Little, Too Slow: Climate adaptation failure puts world at risk,” Adaptation Gap Report 2022, https://www.unep.org/resources/adaptation-gap-report-2022; UNEP, “The Closing Window: Climate crisis calls for rapid transformation of societies,” Emissions Gap Report 2022, https://www.unep.org/resources/emissions-gap-report-2022; M. Krishnan et al., The net-zero transition: What it would cost, what it would bring, McKinsey, January 2022, https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring; L.M. Galindo, B. Hoffman, and A. Vogt-Schilb, “How Much Will It Cost to Achieve the Climate Goals in Latin America and the Caribbean?” Inter-American Development Bank, March 2022, https://publications.iadb.org/en/how-much-will-it-cost-achieve-climate-goals-latin-america-and-caribbean; M. Cárdenas and S. Orozco, “Climate Mitigation in Latin America and the Caribbean: A Primer on Transition Costs, Risk, and Financing,” Center on Global Energy Policy, Columbia University, November 21, 2022, https://www.energypolicy.columbia.edu/publications/climate-mitigation-latin-america-and-caribbean-primer-transition-costs-risks-and-financing/.

UNCTAD, World Investment Report 2023: Investing in Sustainable Energy for All, https://unctad.org/publication/world-investment-report-2023.

M. Conte-Grand, A. Rasteletti, and J.D. Muñoz, “Impuestos a los combustibles en la teoría y en la práctica,” IDB, 2022, https://publications.iadb.org/es/impuestos-los-combustibles-en-la-teoria-y-en-la-practica.

G. Jain, “Thematic Bonds – Financing Net-Zero Transition in Emerging Market and Developing Economies,” Center on Global Energy Policy, Columbia University, December 12, 2022, https://www.energypolicy.columbia.edu/publications/thematic-bonds-financing-net-zero-transition-emerging-market-and-developing-economies/.

Caribbean Catastrophe Risk Insurance Facility – CCRIF, https://www.ccrif.org/about-us.