Spoiler alert: The title of PYMNTS Intelligence’s new report, “Why 60% of Gen Z’s Live Paycheck to Paycheck” gives away a key finding. Six in 10 Generation Z consumers say it’s a challenge to make ends meet.

The report, which was based on surveys with 3,405 U.S. consumers, found that many Gen Z consumers (those born between 1997 and 2006) appear to be having a tough time in the current economy.

Or are they? Is their situation all that different from what the average consumer faces? PYMNTS Intelligence determined that 58% of all U.S. consumers now live from one paycheck to the next, and 59% of Gen Z said they face the same challenge.

In other words, Gen Z consumers are more or less in line with their older peers. Except, unlike many others we surveyed, we found half of Gen Z consumers live in homes where they pay nothing toward their rent or mortgage.

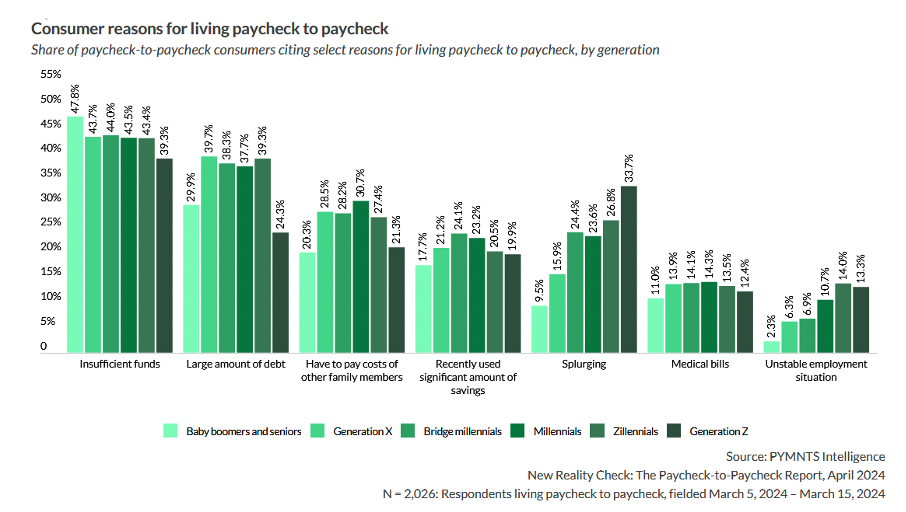

Given that financial leg up, how can so many of them say they are struggling to live within their means? One possible answer might be that Gen Z consumers are splurging on nonessential purchases. This isn’t a judgment call — it’s what Gen Z respondents told us. More than one-third of Gen Z respondents admitted that “splurging” is a chief contributor to their financial distress.

No one is denying that being a young adult in a highly volatile economy is easy. Most Gen Z consumers work in roles that are on the front end of their career paths, including service positions, retail roles and entry-level professional jobs. Also, many are trying to juggle the demands of school.

Whereas 10% of baby boomers and seniors, 16% of Generation X consumers and 24% of millennials confessed that splurging on nonessential items contributes to their financial woes, 34% of Gen Z consumers said the same.

And where large percentages of millennials and bridge millennials said dependent family costs, large amounts of debt and savings-depleting events also contribute to their financial anxiety, fewer Gen Z consumers face any of these financial responsibilities.

As PYMNTS’ Karen Webster reminded readers earlier this month, there are 69 million Gen Z consumers in the U.S., and in less than six years, they will represent a third of the U.S. workforce. Given this looming reality and the financial cushion so many young adults now enjoy because they are free of rent and mortgage responsibilities, now might be an ideal time for Gen Z consumers to start setting aside savings and making financial wellness a priority.