Change is afoot in the art world. Auction houses are registering a 30 per cent increase in new buying clients, while the normalisation of online bids has fostered a democratisation of the industry. Asia is continuing to flourish, with Japan – the go-to destination for HNW travellers in recent years – tipped for a resurgence on the world stage. Then, there is the great wealth transfer – a hot topic in economics which has filtered through to this passion investment market. Baby Boomer collectors are making way for Gen Z, and the landscape needs to keep up.

This year, amid global economic and geopolitical uncertainty, the desire for stability could drive a trend towards an even more rational buyer’s market. With interest rate reductions expected but not yet in place, buyers may approach art purchases with greater caution and consideration. This could result in a softer start to the year, but it also presents an opportunity for collectors to acquire artworks at potentially lower price levels.

[See also: the best art advisers for ultra-high-net-worth collectors]

Collectors, in search of stability, may increasingly focus on ‘safe’ blue-chip artists. By investing in established names, they can feel more ‘comfortable’ in an uncertain market with a long-term sustainable investment. Connoisseurship and selectivity will be vital in an unstable market, as works of scarcity and quality tend to hold their value better.

Auction houses, on the other hand to ensure their turnover, may increase the number of guarantees for artworks to attract potential.

Lower average price levels of comparable artworks could also be expected in 2024. Auction estimates will likely become less speculative, and asking prices on the secondary private market may become more sensible. This shift towards more realistic pricing may lead to increased openness to negotiation. Private sales may increase as an alternative to public auctions. Lower pricing and the desire to protect artists’ results may drive this shift.

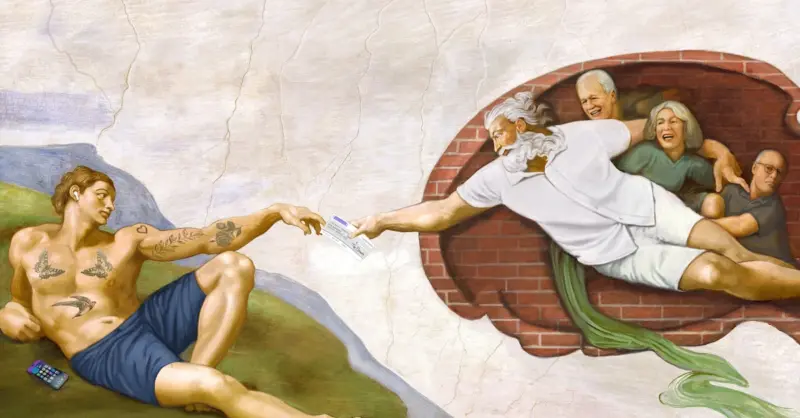

Gen Z collectors make their mark

Another significant development is the continued rising interest in female, younger, and LGBTQ+ artists. As Gen Z enters the art market, there is a growing demand for artists from historically marginalised or underrepresented groups. This trend not only provides new exhibition platforms for these artists but also creates market momentum.

The rising popularity and current revival of cryptocurrencies, such as Bitcoin, may impact the art market. High-quality and recognised NFT art might drive an increase in price from the dramatic turmoil in 2023, driven by the growing adoption of digital currencies and regained wealth of the crypto-currency owners. And fractionalised and tokenised ownership of art could continue to grow in 2024. Tech-savvy investors looking for financial returns may find this model appealing.

Art’s value may also shift towards personal gratification rather than financial returns. As individuals seek emotional connections and personal fulfilment, the intrinsic value of art becomes more important. And art isn’t solely about commerce; it requires a sustainable ecosystem to flourish. Artists, museums, galleries, critics, reviewers, buyers, and collectors all play integral roles. Cultivating such an ecosystem is crucial to the long-term success of contemporary art.

Art market goes (even more) global

And globalisation will continue to shape the art market. Increased access and technology will redefine how collectors build their collections. Cross-category collecting, younger collectors, and emerging markets will play a more significant role in the global art world. And it cannot be excluded that we might face further mergers and take-overs (primary and secondary market) as size, international presence and optimal synergies can be decisive to ‘win the race’.

[See also: Christie’s New York defies sluggish art market with $864 million Fall Marquee Week]

Worldwide, Asia will gain particularly greater international visibility. Asian creativity across various mediums, from art to music and cinema, will continue to influence global culture. Additionally, the Chinese market will undergo a repositioning on the global art stage, with a more nuanced understanding of its nuances and trends. And especially Japan might resurge further as a global art world hotspot, attracting artists, collectors, and dealers. Tokyo could once again become a crucial destination for art enthusiasts.

It’s crucial to remember that these predictions are speculative, and the actual state of the art market in 2024 may differ due to unforeseen events and changing trends. The dynamic nature of the art world and the influence of unpredictable factors should always be considered when forecasting its outlook.

Thomas Reinshagen, previously senior director at Sotheby’s in Zurich, is an independent art and luxury consultant. www.thomasreinshagen.com