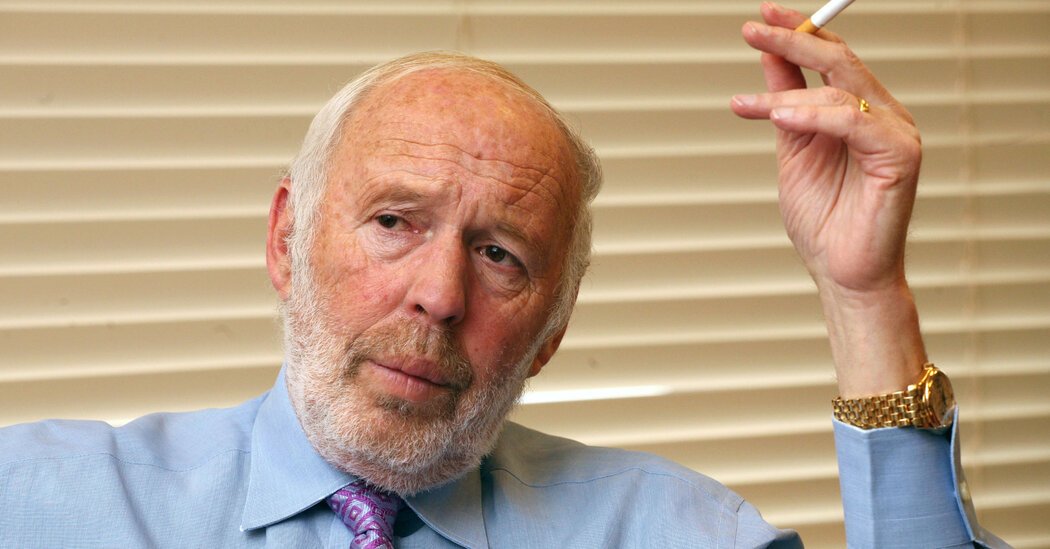

Jim Simons, the prizewinning mathematician who abandoned a stellar academic career, then plunged into finance — a world he knew nothing about — and became one of the most successful Wall Street investors ever, died on Friday in his home in Manhattan. He was 86.

His death was confirmed by his spokesman, Jonathan Gasthalter, who did not specify a cause.

After publishing breakthrough studies in mathematics that would play a seminal role in quantum field theory, string theory and condensed matter physics, Mr. Simons decided to apply his genius to a more prosaic subject — making as much money as he could in as short a time as possible.

So at age 40 he opened a storefront office in a Long Island strip mall and set about proving that trading commodities, currencies, stocks and bonds could be nearly as predictable as calculus and partial differential equations. Spurning financial analysts and business school graduates, he hired like-minded mathematicians and scientists.

Mr. Simons equipped his colleagues with advanced computers to process torrents of data filtered through mathematical models, and turned the four investment funds in his new firm, Renaissance Technologies, into virtual money printing machines.

Medallion, the largest of these funds, earned more than $100 billion in trading profits in the 30 years following its inception in 1988. It generated an unheard-of 66 percent average annual return during that period.

That was a far better long-term performance than famed investors like Warren Buffett and George Soros achieved.

“No one in the investment world even comes close,” wrote Gregory Zuckerman, one of the few journalists to interview Mr. Simons and the author of his biography, “The Man Who Solved the Market.”

By 2020, Mr. Simons’s approach to the market — known as quantitative, or quant, investing — accounted for almost a third of Wall Street trading operations. Even traditional investment firms that relied on corporate research, instinct and personal contacts felt compelled to adopt some of Mr. Simons’ computer-driven methodology.

For much of its existence, Renaissance funds were the largest quant funds on Wall Street, and its style of investing spurred a sea change in the way hedge funds traded and made money for their wealthy investors and pension funds.

By the time he retired as chief executive of the business in 2010, Mr. Simons was worth $11 billion (almost $16 billion in today’s currency), and a decade later his fortune had doubled.

While he continued to oversee his funds as Renaissance chairman, Mr. Simons increasingly devoted his time and wealth to philanthropy. The Simons Foundation became one of the largest private funders of basic science research. And his Flatiron Institute used cutting-edge computational techniques for research into astrophysics, biology, mathematics, neuroscience and quantum physics.

James Harris Simons was born on April 25, 1938, in Cambridge, Mass., the only child of Matthew Simons, the general manager of a shoe factory, and Marcia (Kantor) Simons, who managed the home. A prodigy in mathematics, he did his undergraduate work at the Massachusetts Institute of Technology and was only 23 when he received his doctorate from the University of California, Berkeley.

Beginning in 1964, Mr. Simons taught at M.I.T. and Harvard University while simultaneously working as a breaker of Soviet codes at the Institute for Defense Analyses, a federally funded nonprofit group. But he was fired from the institute in 1968 for publicly expressing strong anti-Vietnam War views.

Over the next decade, he taught mathematics at Stony Brook University on Long Island, part of the State University of New York, and became chairman of its math department. While running the department he won the nation’s highest prize in geometry in 1975.

Then, in 1978, he abandoned his scholarly career and founded Monemetrics, an investment company with offices in a small shopping mall in Setauket, just east of Stony Brook on the North Shore of Long Island. He had never taken a financial course or shown more than a passing interest in the markets. But he was convinced that he and his small team of mathematicians, physicists and statisticians — mainly former university colleagues — could analyze financial data, identify market trends and make profitable trades.

After four roller coaster years, Monemetrics was renamed Renaissance Technologies. Mr. Simons and his growing staff of former scholars initially focused on currencies and commodities. Every conceivable type of data — news reports of political unrest in Africa, bank statistics from small Asian nations, the rising price of potatoes in Peru — was fed into advanced computers to glean patterns that enabled Renaissance to score consistently huge annual returns.

But the real bonanza came when Renaissance plunged into equities, a much larger market than currencies and commodities.

Stocks and bonds were long seen as the purview of Wall Street brokerages, investment banks and mutual fund companies whose young, tireless M.B.A.s analyzed listed companies and turned over their research results to senior wealth managers, who then relied on their experience and instinct to pick market winners. They initially scoffed at the math nerds at Renaissance and their quantitative methods.

A few times, Mr. Simon’s methodology led to costly mistakes. His company used a computer program to buy so many Maine potato futures that it nearly controlled the market. This met with the opposition of the Commodity Futures Trading Commission, the regulatory agency in charge of futures trading. As a result, Mr. Simons had to sell off his investments and miss out on a large potential profit.

But far more often he was so successful that his biggest problem was hiding his trades and research techniques from competitors. “Visibility invites competition, and, with all due respect to the principles of free enterprise — the less the better,” he wrote in a letter to clients.

Business rivals weren’t the only ones eyeing Mr. Simons’s results with envy or suspicion. In 2009, he faced a rebellion from outside investors over the enormous disparity in the performance of different Renaissance Technologies portfolios. The previous year, the Medallion Fund, which was available only to Renaissance present and past employees, registered an 80 percent gain, while the Renaissance Institutional Equities Fund, offered to outside investors, dropped 16 percent in 2008.

In July 2014, Mr. Simons and his firm drew bipartisan condemnation from the Senate Permanent Subcommittee on Investigations for using financial derivatives to disguise day-to-day trading as long-term capital gains. “Renaissance Technologies was able to avoid paying more than $6 billion in taxes,” asserted Senator John McCain, the Arizona Republican, in his opening statement at the subcommittee hearing.

Both Mr. Simons and his onetime co-chief executive, Robert Mercer, were among the largest financial contributors to politicians and political causes. While Mr. Simons generally backed liberal Democrats, Mr. Mercer was fervently right-wing and became a leading funder of Donald Trump’s presidential campaigns.

In 2017, Mr. Simons, then chairman of Renaissance Technologies, fired Mr. Mercer as C.E.O. because his political activities were provoking other key Renaissance executives to threaten to resign. Mr. Mercer stayed on as a researcher. According to both men, they remained friendly and continued to socialize.

In 2011, his foundation gave $150 million to Stony Brook University, with most of the money going to research in medical sciences. At the time, it was the biggest gift ever bestowed in SUNY’s history.

Last year, the foundation outdid that gift with a $500 million donation to Stony Brook, which called it the largest unrestricted endowment gift to a higher education institution in American history.

As he became older and wealthier, Mr. Simons enjoyed a lavish life style. He purchased a 220-foot yacht for $100 million, bought a Fifth Avenue apartment in Manhattan and owned a 14-acre estate in East Setauket, overlooking Long Island Sound. A chain-smoker, he refused to put out his cigarettes in offices or at conferences and willingly paid fines instead.

His first marriage, to Barbara Bluestein, a computer scientist, with whom he had three children — Elizabeth, Nathaniel and Paul — ended in divorce. He then married Marilyn Hawrys, an economist and former Stony Brook undergraduate who received her doctorate there. They had two children, Nicholas and Audrey.

Paul Simons, 34, was killed in a bicycle accident in 1996, and Nicholas Simons, 24, drowned off Bali, Indonesia, in 2003. His wife and other children survive him, as do five grandchildren and one great-grandson.

Mr. Simons lamented to a friend about the deaths of his sons, according to his biographer, saying, “My life is either aces or deuces.”

Hannah Fidelman contributed reporting.