UNEMPLOYMENT has unexpectedly fallen across the UK and wages growth slowed to its lowest level in two years, new data shows.

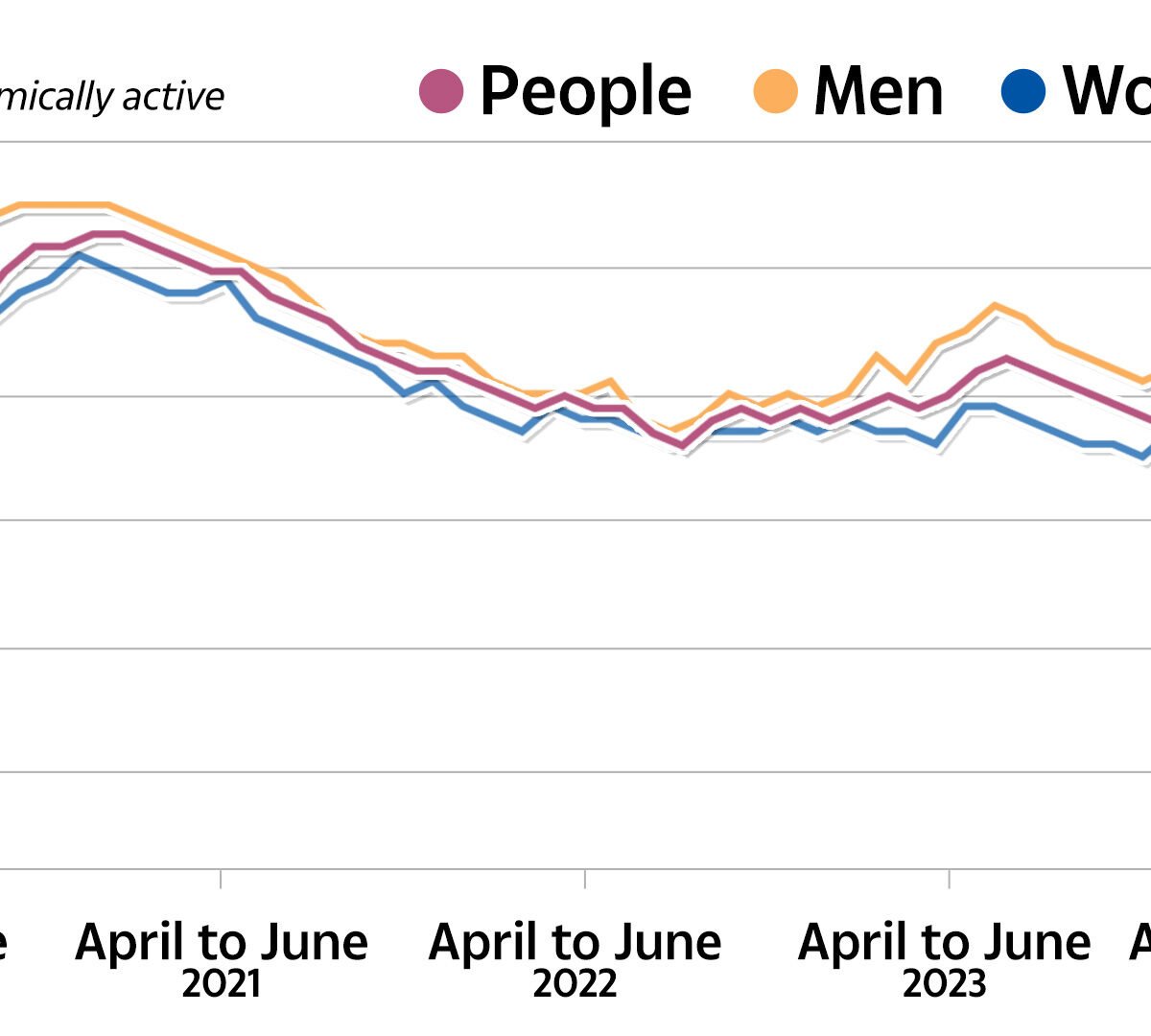

The rate of unemployment fell to 4.2% between April and June, down from 4.4% for the previous three months.

That’s according to the latest official figures fromThe Office for National Statistics (ONS).

Experts had predicted that unemployment would rise.

Wages, excluding bonuses, rose 5.4% year on year between April and June, the ONS said, compared to 5.7% for the three months to June

It’s the slowest increase in wages since 2022.

Taking into account inflation, wages went up 2.4%

Liz McKeown, director of economic statistics at the ONS, said: “Basic pay growth, while remaining relatively strong, continues to slow.

“Growth in total pay slowed markedly, with last year’s one-off NHS bonuses affecting the comparison.

“There was a fall in the unemployment rate, which is now lower than a year ago.”

The latest figures from the ONS also reveal there were an estimated 884,000 job vacancies in the UK in May to July.

That’s a 26,000 fall or 2.8% drop from the period February to April.

The ONS said the number of job vacancies decreased in the last quarter for the 25th consecutive period.

However, Ms McKeown added: “The medium-term picture remains somewhat subdued with the employment rate still lower than a year ago and the growth rate in the number of payrolled employees having slowed over the year.

“The number of job vacancies continues to decline, although the total number remains above pre-pandemic levels.”

Speaking on BBC Radio 4s Today programme, she said there were “signs of cooling” in the latest data and in recent “particularly in relation to the earnings and vacancies figures we’ve seen” adding that it’s a “mixed picture”.

UNEMPLOYMENT RATE FALLS

Lower unemployment rates are good news as it means more people are in work and earning money.

It also means more money is being pumped into the economy which can see GDP rise.

When GDP goes up, it means the economy is growing and the Government has more funds to spend on public services.

That means more money pumped into local libraries, schools and transport networks.

It can also see taxes fall as the Government has less of a need to top up its coffers.

That said, the latest figures show while unemployment has fallen, economic activity is at near-record levels.

Rachel Reeves, Chancellor of the Exchequer, said: “Today’s figures show there is more to do in supporting people into employment because if you can work, you should work.

“This will be part of my Budget later in the year where I will be making difficult decisions on spending, welfare and tax to fix the foundations of our economy so we can rebuild Britain and make every part of our country better off.”

SLOWING WAGE GROWTH

While wages are rising, they are are going up at a slower rate than before.

Steady growth is expected to keep up with rising prices so that workers are not worse off.

In recent years wage growth has been higher as employers have bumped up pay to keep up with runaways inflation.

The rate of inflation has now fallen back to the Bank of England’s target of 2%, though new figures are set to be released tomorrow and experts expect a small increase to 2.3%..

Rising wages can fuel inflation.

The Bank of England (BoE) has previously hiked interest rates to tackle high inflation, hitting a 16-year high of 5.25%.

At the start of August it made its first cut to 5% after inflation hit its 2% target.

The move brought relief for millions facing high mortgage rates, which are based on the BoE rate.

However the decision was on a “knife edge” with five member of the rate-setting committee voting to lower rates and four voting to hold.

Yesterday, Catherine Mann, a rate setter on the BoE’s Monetary Policy Committee, which decides what to set the base rate at, said inflation could still rise with wages and prices expected to increase.

Ms Mann was one of four policymakers who voted to leave rates unchanged at the last meeting, at 5.25%, although five others voted for it to drop to 5%.

“Inflation has come down but… we shouldn’t be seduced by headline inflation because of the role of energy and external aspects working through,” she told the Financial Times.

Why does inflation matter?

INFLATION is a measure of the cost of living. It looks at how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

Usually people measure inflation by comparing the cost of things today with how much they cost a year ago. The average increase in prices is known as the inflation rate.

The government sets an inflation target of 2%.

If inflation is too high or it moves around a lot, the Bank of England says it is hard for businesses to set the right prices and for people to plan their spending.

High inflation rates also means people are having to spend more, while savings are likely to be eroded as the cost of goods is more than the interest we’re earning.

Low inflation, on the other hand, means lower prices and a greater likelihood of interest rates on savings beating the inflation rate.

But if inflation is too low some people may put off spending because they expect prices to fall. And if everybody reduced their spending then companies could fail and people might lose their jobs.

See our UK inflation guide and our Is low inflation good? guide for more information.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories