Student loans can feel like a burden for many new graduates as they realise they will have to start paying them back. We chat with Money Expert’s Liz Hunter for the best tricks to pay it off more easily, as well as busting common myths

As students wave goodbye to their university bubbles, ready to head into the real world of work, their minds will shift from wondering how cheap they can get their booze to thinking about paying off their student loans.

Student loans make studying in the UK much easier, but it doesn’t mean once you finish studying you can forget about it.

Recent figures obtained by the BBC, show almost 1.8 million people are now in at least £50,000 of UK student debt, and the figure is rising. This can make anyone question whether being in this amount of debt was really worth it, not to mention the overwhelming feeling of wondering if you will ever truly be able to pay it back. These balances can also rise for those studying lengthy or multiple courses – which also rise rapidly with interest.

The Student Loans Company (SLC) previously said the average balance for loan holders in England when they start making repayments was less than £45,000. New government data shows that the amount has now risen to £48,470.

This is enough to make anyone think twice, but Liz Hunter, director at Money Expert has dispelled some of the most common myths and fears around student loans. She said the most common complaint she hears is that people are worried they will be in a constant cycle of paying back – but never actually paying it off.

“Standard loans must be paid in full whereas your student loan debt is wiped when you’re 65 or the 30 years after the April you were first due to repay the loan – whichever comes first,” the expert explained. She said that unlike standard loans, repayments are also worked out by how much you earn, rather than by how much you borrow. So, if you were earning under £25,000, you wouldn’t have to pay anything back unless your wages rose. If you were to never earn over £25K, you won’t pay anything, and it will get wiped after 30 years.

While student loans aren’t like standard loans, it can still be stressful having debt hanging over you. This could lead to anxiety and stress, you may even feel pressured into finding well-paid jobs as soon as you graduate to help you pay off your loan quicker. Some also feel guilt or shame over never being able to fully pay the debt off.

However, Liz urged students to not worry too much about how the debt will impact them in the future. She said: “Student loans can impact your eligibility to get a mortgage, but not in the same way that other debts do. A poor credit score is likely to impact your eligibility for a mortgage, but thankfully, student loans don’t affect your credit score, unlike other types of loans or finance.

“On the other hand, student loans do factor into your ‘affordability’. This is when the lender looks at your ingoings and outgoings to gauge whether you’ll be able to afford a monthly mortgage repayment. If this is an issue for you, you can increase your ‘affordability’ by saving for a larger deposit or attempting to reduce back your other monthly outgoings, such as bills, food expenses or car loan repayments.”

Another way to pay off your student debt easily is if you become a teacher. Many teachers can get their loan payments back for most of the academic year – which means more money. Especially if you become a secondary school teacher, and spend 50% of your time teaching either physics, biology, chemistry, computing or languages and are employed at an eligible state school, you can apply for refunds of all payments made from September each academic year.

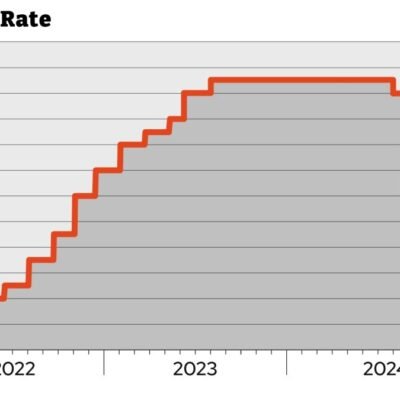

Student loans have come under fire due to their rising interest rates which can make taking out the loans uncertain. Liz explained that this rate can vary, depending on the type of loan you have, as well as your income. For example, if you started your course after 2012, you’ll be charged up to 5.6% interest per year.

This means that your debt can grow faster than it takes you to repay it, leaving you in a long cycle of repaying your debt but never paying it off. It also means that repaying your student loan can take decades, with some never paying it off at all, she explained.

“I believe the interest rate on student loans should be reduced dramatically – or even scrapped entirely. High interest rates significantly increase the total amount a student repays over time. In fact, in most cases, students will pay more in interest than they ever owed on their actual loan,” Liz added.

Not only can this burden lead to long-term financial strain, especially for those on a lower income, but it could put ambitious graduates off starting a business or furthering their studies. While some may be in a position to be fortunate enough to pay their loan off, Liz urged them to weigh up if it is necessary.

“With normal loans, some lenders will charge a fee for early repayments, while the Student Loans Company doesn’t charge fees and you can pay the debt off early if you wish. However, you should weigh up whether it’s worth paying it off early as it may be worth putting your extra cash to better use.

“For example, if you have other debt you could use this money to clear it, you could put it into a high-interest savings account or start saving for a deposit if you don’t own your own home. Remember, any remaining debt is wiped after 30 years anyway.”

Although many do see their student loan as just another tax, Liz said they still “need to be taken seriously” and added: “They’re a serious financial commitment and, even if they’re not repaid in full, are likely to require significant monthly repayments for decades.”

Do you have a story to share? Email niamh.kirk@reachplc.com