(AI Video Summary)

Previous TUI and EUR/USD trading outcomes

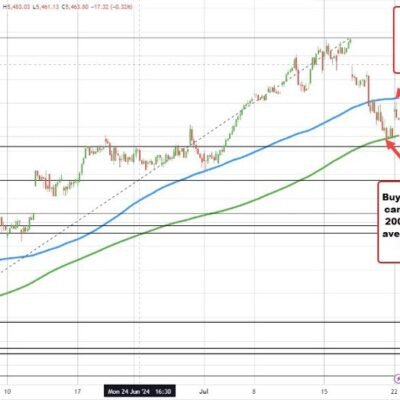

In the latest episode of “Trading the trend”, Axel Rudolph covers strategic decisions in trading with a focus on the importance of setting stop-loss orders correctly. A vivid recount of going long on TUI’s share price revealed an unexpected downtrend, yet due to a strategically placed stop-loss, the position remains open.

Similarly, insights on EUR/USD trades highlighted maintaining positions with adjusted stop losses.

This week’s trading opportunity

Additionally, a new perspective is introduced on trading natural gas futures, suggesting a short position based on recent price resistance and anticipated downtrends. It is advised to go short with a stop loss at 3.140, and a downside target at 2.150.